Cardano Price Sends a Clear Warning After Back-to-Back Breakdowns— $0.25 Now in Focus

Cardano price is trading near its weakest levels of the year. The token is down roughly 24% over the past 30 days and about 5% over the past 24 hours, hovering close to its yearly low near $0.37. What makes this move stand out is not just the size of the drop, but the structure behind it.

In the span of just two months, Cardano has completed two separate bearish continuation breakdowns, putting fresh pressure on the chart and raising the risk of a deeper move.

Two Bearish Breakdowns in Two Months Signal Structural Weakness

The first breakdown formed in early November. ADA built a bearish flag through late October, then broke down around November 11. That move led to a sharp decline, with the price falling roughly 38% from the flag’s high.

After a brief consolidation, Cardano repeated the pattern. A second bearish flag developed through late November and early December. On December 11, ADA broke down again, confirming a second continuation move in just two months.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

When markets print repeated bearish continuation patterns without meaningful recovery, it signals sustained seller control rather than panic selling. If the current breakdown follows the same measured-move logic as the first, downside targets begin clustering near the $0.25 zone.

Why This Weakness Itself Could Limit Further Damage

Despite the bearish structure, there are two factors that slightly soften the downside risk.

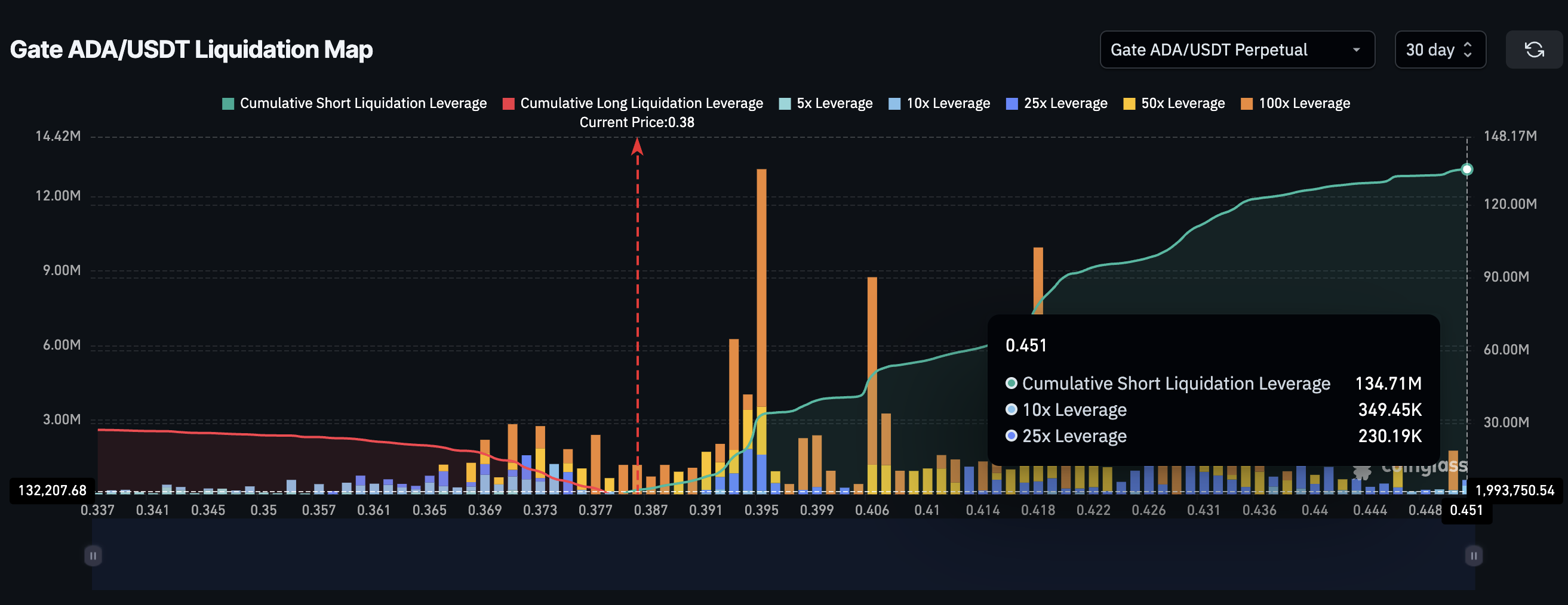

First, derivatives positioning is already skewed heavily bearish. Gate’s liquidation data shows long leverage is thin, with only about $27 million in long positions, while short exposure sits near $135 million, 5x more. Most long liquidation clusters end around $0.36, meaning forced selling pressure drops sharply at that level. Fewer crowded longs reduces the chance of a liquidation cascade.

Second, long-term holder behavior has stabilized. The 1-year-to-2-year cohort, often viewed as higher-conviction holders, has sharply reduced spending, as seen via the Spent Coin metric, which groups coin movements by cohorts.

Coins moved by this group fell from 666.24 million ADA to just 2.48 million ADA since December 10, a decline of almost 99.6%. That suggests selling pressure from committed holders is drying up, even as the price remains weak.

In simple terms, ADA’s weakness has scared off leverage and slowed long-term selling, which can act as a temporary brake during broader market stress.

Key ADA Price Levels to Watch

The Cardano price chart remains fragile. $0.36 is the most important near-term support. The same level is highlighted by the liquidation map shared earlier.

A clean break below it opens the door to $0.33, and from there, the measured breakdown target near $0.25 comes into focus.

For any bullish reset, ADA would need to reclaim $0.48. Without that, rallies remain corrective, not trend-changing.

For now, Cardano sits in a dangerous spot.

Two breakdowns in two months define the trend. Weakness itself may slow the fall; however, unless the structure improves, the risk of a $0.25 test cannot be ignored.

The post Cardano Price Sends a Clear Warning After Back-to-Back Breakdowns— $0.25 Now in Focus appeared first on BeInCrypto.