Arthur Hayes Sticks To His Extreme Bitcoin Price Prediction for Year-End

Arthur Hayes is standing by his prediction that Bitcoin could reach $200,000–$250,000 by the end of 2025, despite the October–November crash and lingering market fear.

Speaking on the Milk Road Show on November 26, he said the recent drop to $80,000 marked the cycle bottom and argued that global dollar liquidity has turned a corner.

“I’m going to stick with it,” Hayes said when asked if his $200,000–$250,000 target still holds with only weeks left in the year. “If I’m wrong it doesn’t matter… I’m long, I’m still happy either way.”

Hayes Calls $80,000 the Bottom After Liquidity Shock

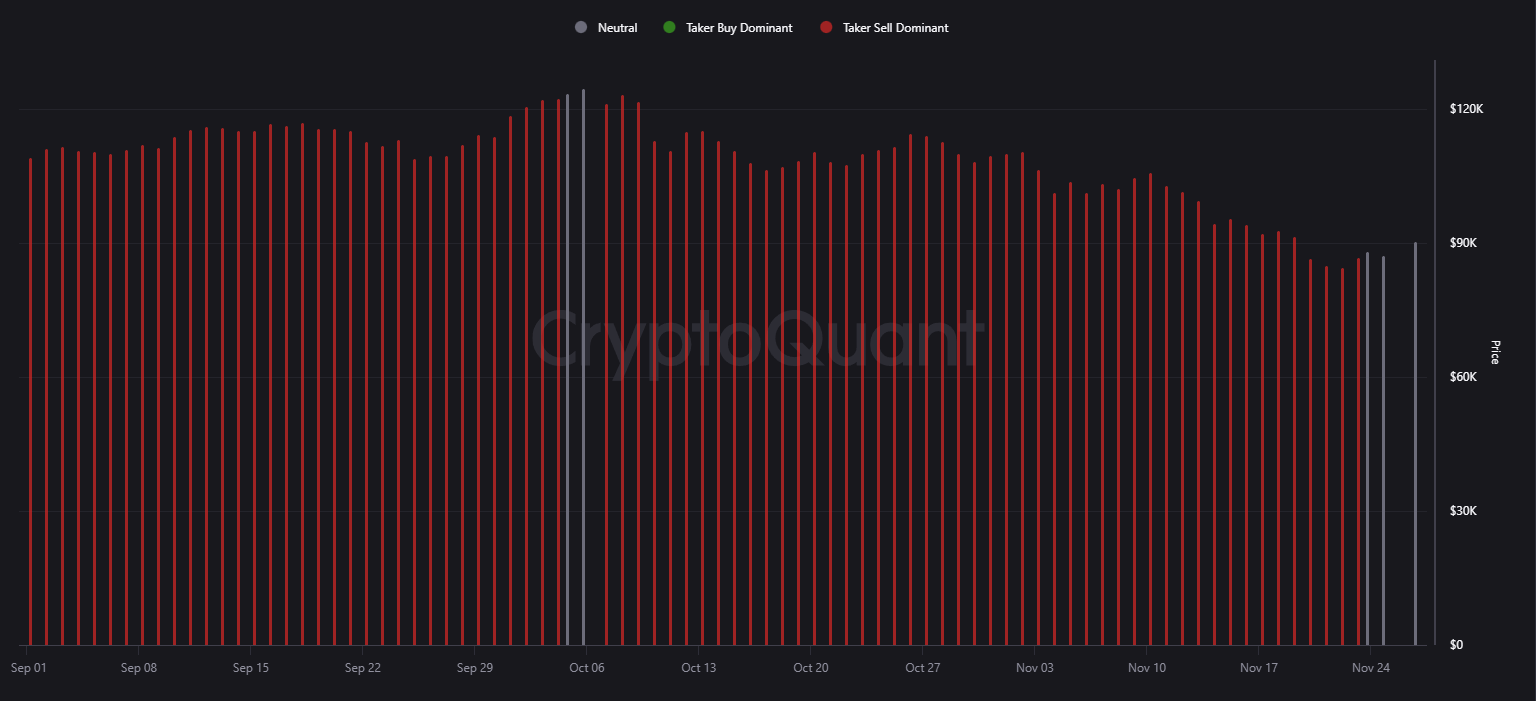

Hayes framed the entire move from Bitcoin’s $125,000 high down to $80,000 as a liquidity-driven reset, not the start of a new bear market.

He said his Bloomberg-based US dollar liquidity index showed about $1 trillion drained from dollar money markets between July and now.

This came from the US Treasury refilling its account and the Federal Reserve continuing quantitative tightening.

People think Bitcoin runs on halving cycles.

— Quinten | 048.eth (@QuintenFrancois) November 28, 2025

Wrong.

It runs on liquidity, politics and the US business cycle. Which hasn’t even started yet.

2026 is where the fireworks starts:

– QT ending

– The US Midterm election

– Booming economy and stock market for reelection purposes

-… pic.twitter.com/aiyOOlODm1

According to Hayes, Bitcoin ignored that liquidity drain for months because ETF inflows and Digital Asset Treasury (DAT) issuances masked the damage.

Once those flows flipped, he said, Bitcoin “fell down to where it should have been based on the dollar liquidity situation.”

ETF “Institutional Bid” Was Just a Basis Trade

Hayes argued that the widely celebrated ETF bid was badly misunderstood by retail traders.

The largest holders of BlackRock’s IBIT ETF are firms like Brevan Howard, Goldman Sachs, Millennium, Jane Street and Avenue.

These are not long-only Bitcoin believers, he stressed, but basis traders exploiting a spread.

“They’re taking the IBIT ETF, they buy it, they pledge it with their broker, then they sell a futures contract… they were making let’s call it 7 to 10% per annum on that trade,” he said.

As funding rates fell in September and October, those players unwound the trade by selling ETFs and buying back futures, turning ETF flows negative.

Retail investors then misread the outflows as “institutions dumping Bitcoin,” Hayes said, without understanding that institutions were only unwinding a funding strategy.

JP MORGAN IS MOVING BITCOIN INTO THE $318 TRILLION BOND MARKET.

— Bull Theory (@BullTheoryio) November 28, 2025

JP Morgan has launched a new structured note that gives investors exposure to Bitcoin through BlackRock’s spot ETF (IBIT).

This matters because it pulls Bitcoin directly into the traditional bond and fixed-income… pic.twitter.com/HZQLM9YgGG

Hayes also highlighted the role of Digital Asset Treasury companies, which issue stock and debt to buy Bitcoin when their market NAV trades at a premium.

When those stocks fell to par or discount, he said, this model broke. DATs could no longer issue new securities in an accretive way.

Some even had an incentive to sell Bitcoin and buy back their own shares.

“All we know is that we have essentially bottomed on the liquidity chart and the direction in the future is higher,” he said. “That’s why I believe that the $80,000 dip on Bitcoin recently is the bottom.”

He expects the next leg of liquidity to come less from the Fed and more from the commercial banking system, pointing to early signs of renewed bank lending and political plans for a credit-fuelled industrial build-out.

Why Bitcoin Is “Stuck” Around $90,000 For Now

Asked why Bitcoin still trades near $90,000 if the liquidity outlook is improving, Hayes pointed to uncertainty over how aggressively the new US administration will actually create credit.

Markets, he said, still question how and when another “$10 trillion” of liquidity will materialise.

Promises about bank lending, industrial policy, and a new Fed chair remain political talk until they turn into concrete programs and flows.

“Once we actually start to see things happen, markets will price a bigger forward on where this dollar liquidity situation is and risk assets like Bitcoin will accelerate their rise in price,” Hayes said.

The post Arthur Hayes Sticks To His Extreme Bitcoin Price Prediction for Year-End appeared first on BeInCrypto.