Jepang Perketat, Amerika Longgarkan: Bank Sentral Mana yang Sebenarnya Pengaruhi Pasar Saat Ini? | Berita Kripto AS

Selamat datang di US Crypto News Morning Briefing—ringkasan penting untuk perkembangan paling utama di dunia aset kripto hari ini.

Siapkan kopi karena Morning Briefing kali ini tidak hanya soal suku bunga. Kita juga akan membahas soal leverage, funding, dan pihak mana di Pasifik yang sebenarnya paling menentukan irama risiko aset ketika kebijakan berlawanan arah. Satu bank sentral melonggarkan kebijakan (AS), sedangkan yang lain mengetatkan (Jepang). Ketegangan di antara keduanya mulai mengubah likuiditas global dengan cara-cara yang tidak langsung terlihat di satu grafik atau candle harga.

Berita Kripto Hari Ini: Jepang Naikkan Suku Bunga, namun The Fed Turunkan, yang Mana Lebih Berdampak Kuat?

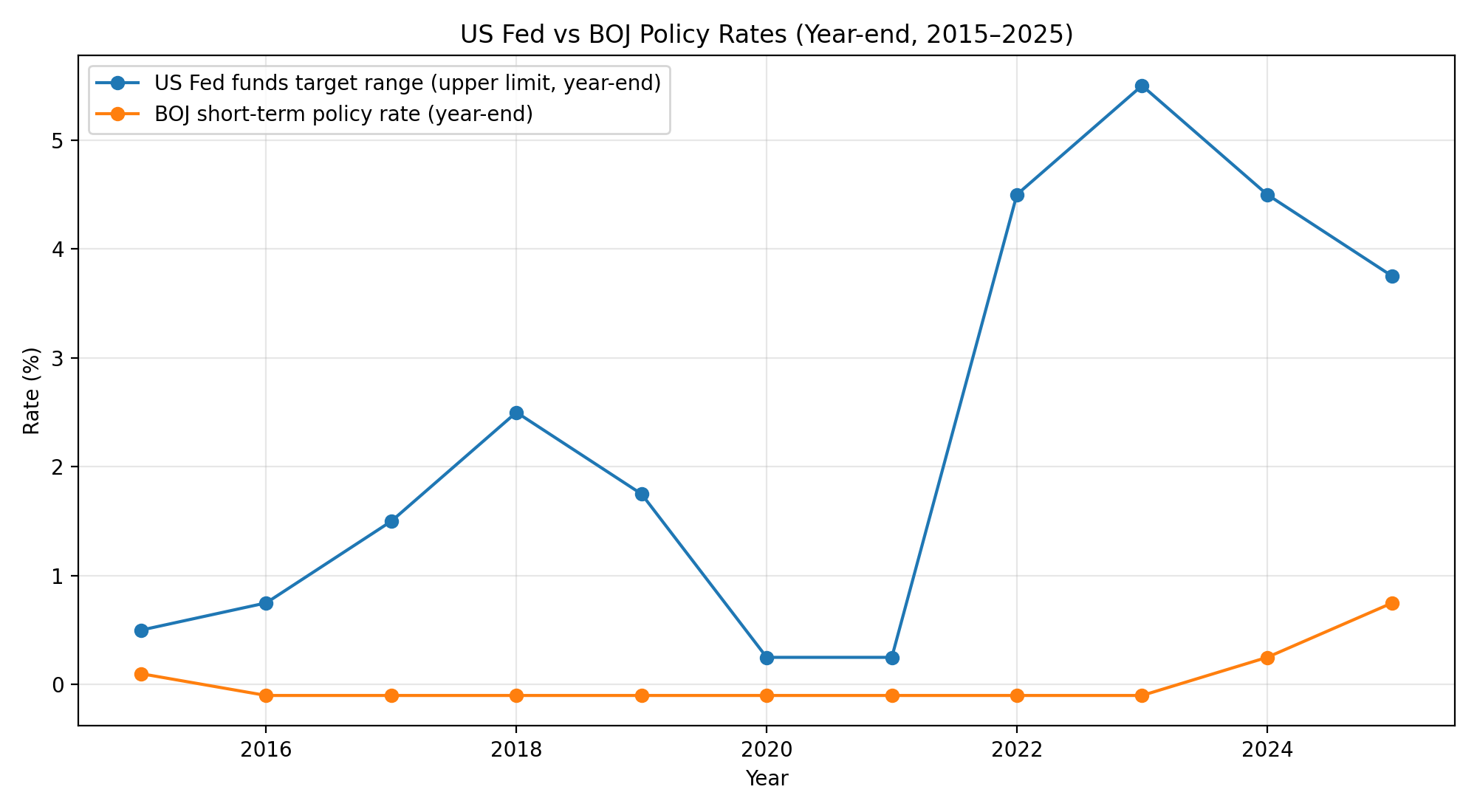

Pada saat ini, pasar global berada di persimpangan jalan, di tengah perbedaan kebijakan yang jarang terjadi dan sangat penting. Di satu sisi, The Fed AS sudah memangkas suku bunga untuk mendukung pertumbuhan yang melambat. Sebaliknya, Bank of Japan (BOJ) justru bergerak ke arah sebaliknya, menaikkan suku bunga ke level yang belum terlihat selama tiga dekade terakhir.

Pertanyaan yang dihadapi investor sekarang bukan lagi apakah langkah-langkah ini penting, tetapi kebijakan mana yang akhirnya lebih berpengaruh untuk likuiditas global, mata uang, dan pasar kripto.

Pada 19 Desember, BOJ menaikkan suku bunga acuan sebesar 25 basis poin menjadi 0,75%, level tertinggi sejak 1995. Ini menandai satu langkah lagi meninggalkan kebijakan moneter super longgar selama puluhan tahun. Para analis makro melihat langkah ini lebih dari sekadar perubahan kecil.

🚨 BREAKING: 🇯🇵 BOJ DELIVERS THE HIKE

— Wise Advice (@wiseadvicesumit) December 19, 2025

Rates raised 25 bps to 0.75%, marking a 30-year high.

Japan’s era of ultra-easy money keeps fading.

This is a major global LIQUIDITY shift… watch yen and risk assets closely. 👀 pic.twitter.com/vfciRH84WJ

Berbeda dengan pemangkasan suku bunga The Fed yang bersifat siklus dan dirancang untuk menghaluskan perlambatan ekonomi, pengetatan di Jepang bersifat struktural. Selama hampir 30 tahun, suku bunga Jepang yang mendekati nol telah menjadi salah satu sumber leverage murah terbesar di dunia.

Bahkan sedikit kenaikan sekarang membawa konsekuensi besar karena mengganggu strategi pendanaan yang selama ini mengakar di berbagai pasar global.

Dampak langsungnya paling terlihat di pasar mata uang. Meskipun kenaikan suku bunga ini bersejarah, yen sempat melemah karena Gubernur Kazuo Ueda hanya memberikan penjelasan terbatas soal kecepatan pengetatan di masa depan.

Reuters menyebutkan bahwa nilai yen turun karena BOJ “tetap samar soal arah pengetatan.” Hal ini memperlihatkan bahwa forward guidance, bukan hanya kenaikan suku bunga itu sendiri, tetap sangat penting.

Meski demikian, para analis berpendapat jalur transmisi utamanya ada di tempat lain: yen carry trade, seperti yang dilaporkan dalam US Crypto News terbaru.

Saat yield Jepang naik dan selisih suku bunga AS–Jepang menyempit, meminjam yen untuk mendanai posisi yang memberikan imbal hasil lebih tinggi jadi makin mahal.

Fed cut rates, but the message mattered more than the cut. Their dot plot now shows fewer cuts ahead. That flipped expectations from “easy money coming” to “higher for longer.” At the same time, BOJ hike expectations strengthened the yen → yen carry trades started unwinding →… pic.twitter.com/eSaJLWQajg

— Dmytro V7 🇺🇦 (@V7Dmytro) December 16, 2025

Di sinilah perbedaan antara Tokyo dan Washington menjadi sangat penting:

- Pemangkasan suku bunga The Fed biasanya secara bertahap mendukung pasar dengan melonggarkan kondisi kredit.

- Berbeda dengan itu, pengetatan dari BOJ memaksa pasar untuk langsung mengubah posisi karena biaya leverage meningkat.

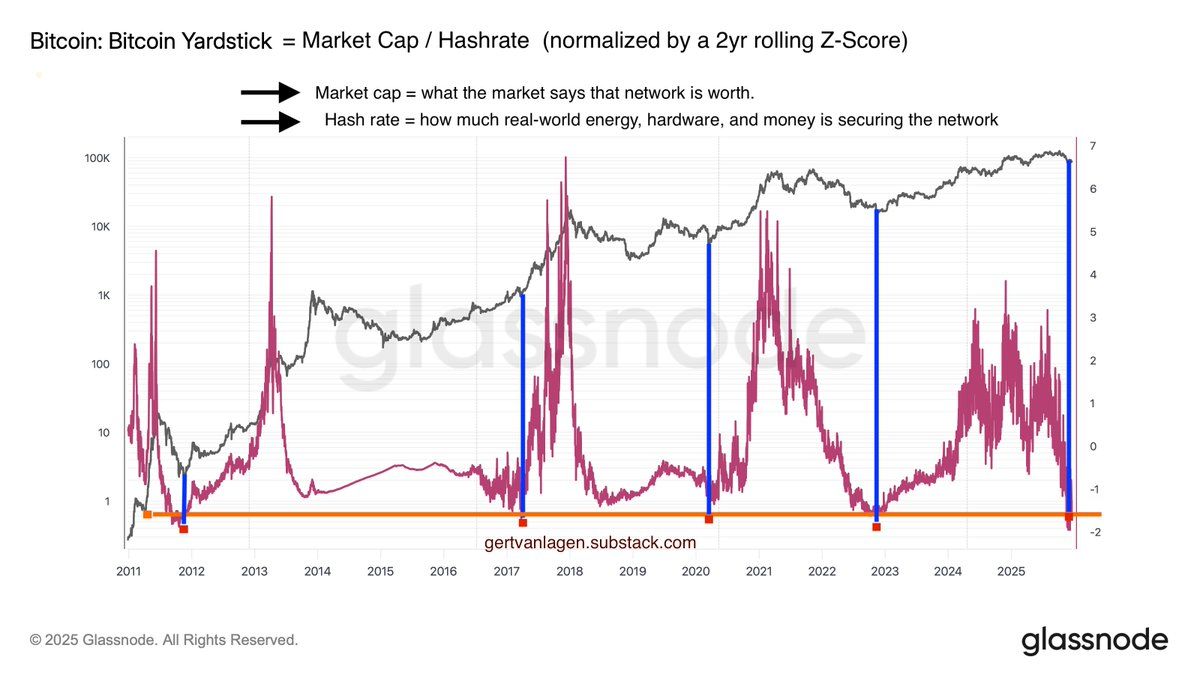

Pasar kripto selama ini merasakan dampak tersebut lebih cepat dibandingkan aset tradisional. Siklus pengetatan BOJ sebelumnya sering bersamaan dengan penurunan harga Bitcoin tajam sebesar 20–30% ketika likuiditas mengetat dan carry trade terurai.

THE BANK OF JAPAN MIGHT BE BITCOIN’S BIGGEST ENEMY

— Merlijn The Trader (@MerlijnTrader) December 14, 2025

Japan holds the most US debt.

Every time they hike, Bitcoin bleeds:

March 2024: -23%

July 2024: -30%

Jan 2025: -31%

Next hike: Dec 19

Next move: loading…

If the pattern repeats, $70K is in play. pic.twitter.com/R5916R702I

Pola ini membuat kestabilan Bitcoin belakangan menjadi sangat mencolok. Pada waktu publikasi, BTC berada di harga US$88.035, naik hampir 1% dalam 24 jam terakhir.

“History shows every prior tightening triggered 20–30% Bitcoin drops as yen carry trades unwound and liquidity tightened. Yet with the hike fully priced in and BTC holding around $85k–$87k, this could be the dip buyers have been waiting for,” tulis analis Blueblock.

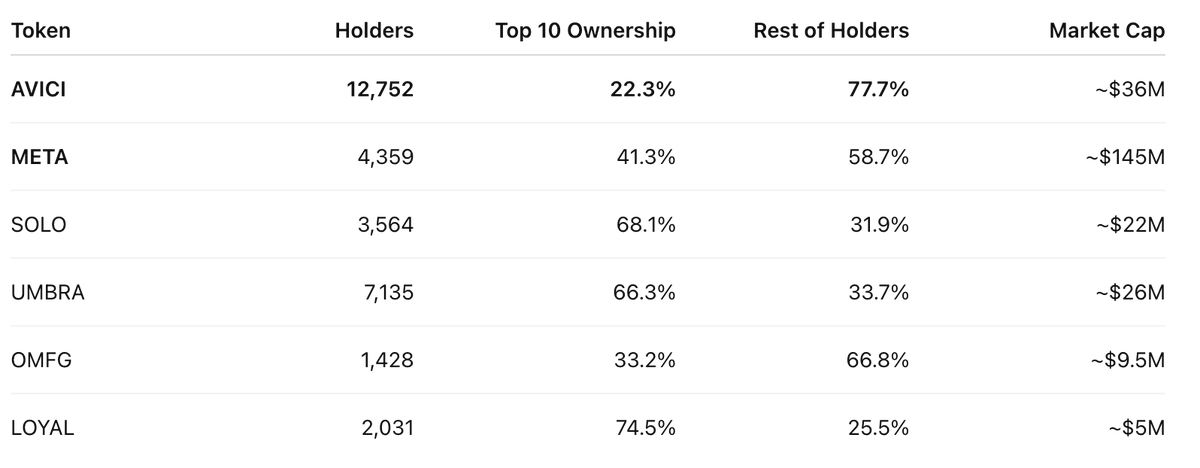

Meski begitu, ketahanan di puncak pasar kripto tidak menghilangkan risiko di tempat lain. Altcoin, yang jauh lebih sensitif terhadap kondisi likuiditas, tetap terpapar jika pengetatan di Jepang masih berlanjut.

Faktanya, pejabat BOJ secara terbuka sudah menyatakan kesediaannya terus mengetatkan kebijakan jika pertumbuhan upah dan inflasi masih kuat. Analis dari ING dan Bloomberg telah memperingatkan bahwa walaupun kenaikan berikutnya tidak akan terjadi dalam waktu dekat, arahnya sudah jelas.

Dampaknya bagi pasar global sangat jelas. Pemangkasan suku bunga dari The Fed mungkin memberikan dukungan dalam jangka panjang, tapi keluarnya Jepang dari kebijakan super longgar justru menghantam langsung fondasi leverage dunia. Jika BOJ terus di jalur ini, pengaruhnya ke likuiditas, mata uang, dan kripto bisa jadi lebih besar dari pelonggaran AS, setidaknya dalam waktu dekat.

Chart Hari Ini

Alpha dalam Ukuran Kecil

Berikut rangkuman berita aset kripto AS lainnya yang perlu kamu pantau hari ini:

- Apa sinyal indikator historis 100% akurat untuk Bitcoin di bulan Desember?

- ADA turun 70% di 2025 — Tapi dua sumber permintaan baru mulai muncul untuk Cardano.

- Apakah Toncoin undervalued? Data Desember memberi sinyal peluang rebound.

- Tekanan jual XRP turun 39%, namun level harga ini tetap menentukan hasil akhirnya.

- Para whale Bitcoin bergerak — Tapi tidak seperti dugaan pasar.

Gambaran Umum Pre-market Crypto Equities

| Perusahaan | Penutupan 18 Desember | Ringkasan Pre-Market |

| Strategy (MSTR) | US$158,24 | US$163,97 (+3,62%) |

| Coinbase (COIN) | US$239,20 | US$246,00 (+2,84%) |

| Galaxy Digital Holdings (GLXY) | US$22,51 | US$22,95 (+1,95%) |

| MARA Holdings (MARA) | US$9,69 | US$9,87 (+1,86%) |

| Riot Platforms (RIOT) | US$13,38 | US$13,73 (+2,62%) |

| Core Scientific (CORZ) | US$14,56 | US$15,04 (+3,30%) |