3 Altcoins To Watch This Weekend | December 20 – 21

The crypto market is heading into the final week of 2025, and this will be the second last weekend of the year. As Bitcoin and the altcoins alike have been directionless, external factors may act as catalysts in the coming days.

BeInCrypto has analysed three such altcoins that present interesting opportunities for investors this weekend.

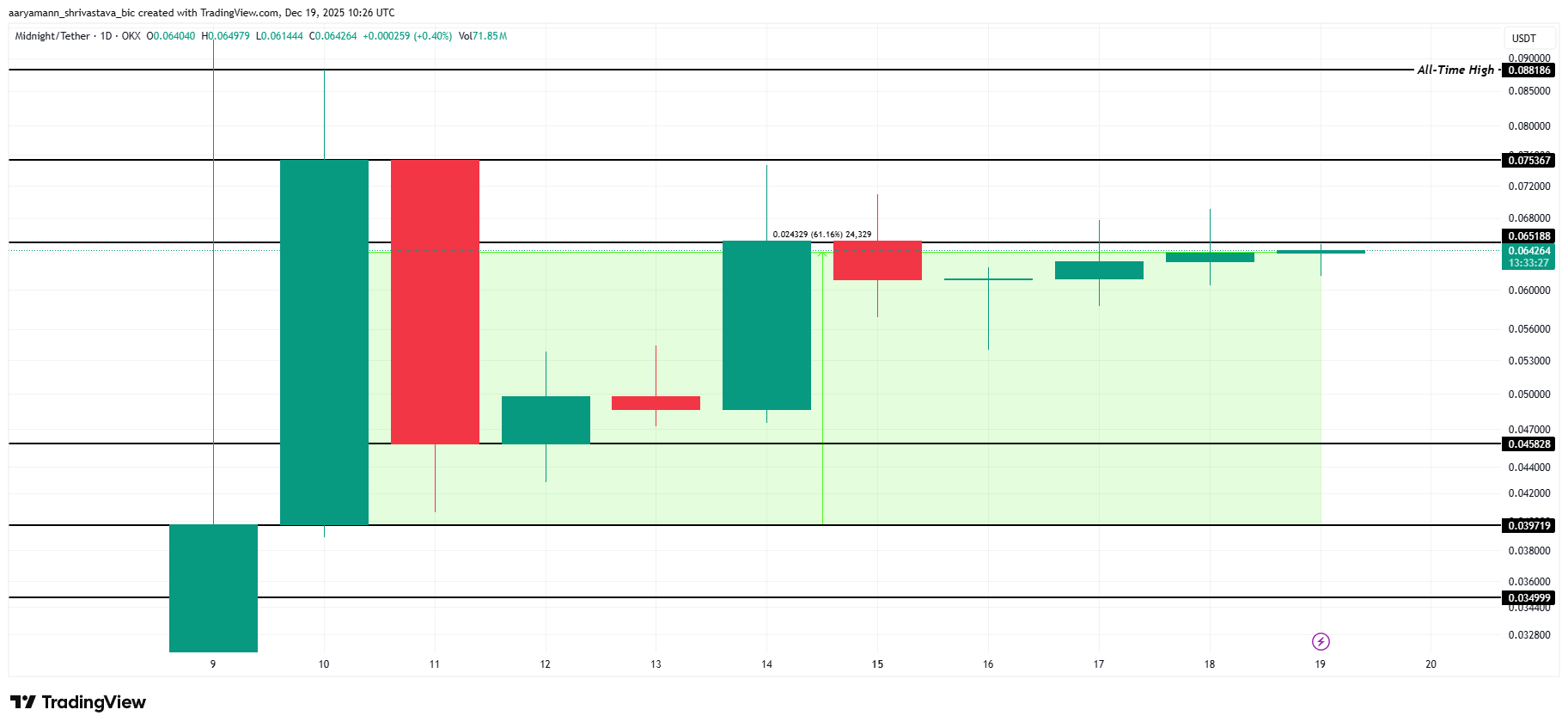

Midnight (NIGHT)

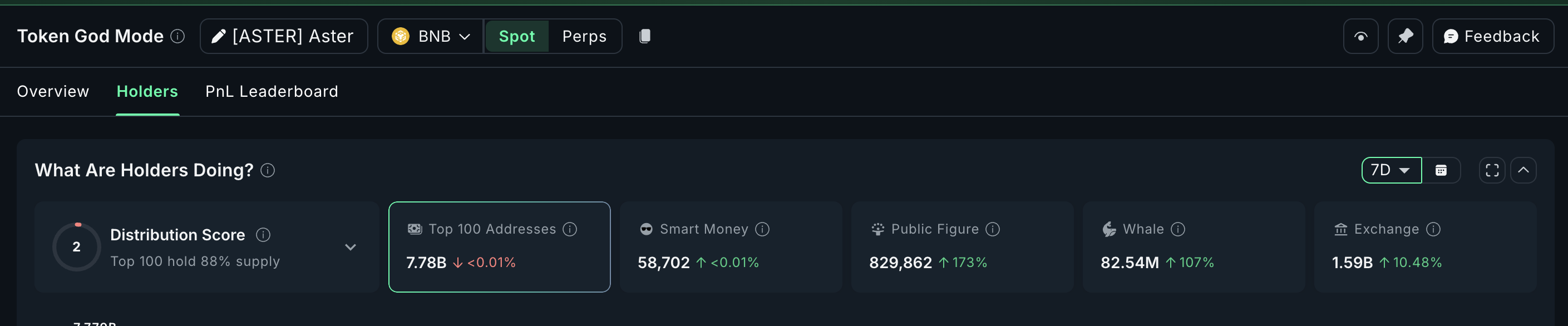

NIGHT has emerged as the best-performing altcoin of the week, gaining 61% since launch. Strong early momentum continues to attract speculative interest. The sharp rise reflects heightened demand from traders seeking exposure to newly launched assets with high growth narratives.

Investor interest is driven by NIGHT’s development ties to Charles Hoskinson and the Cardano ecosystem through the Midnight blockchain. The token now exceeds a $1 billion market cap. Trading near $0.064, NIGHT could break $0.065 and $0.075, targeting the $0.088 all-time high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risks remain elevated for a newly launched token. Premature profit-taking could reverse momentum quickly. If selling pressure increases, NIGHT may fall toward $0.045. Such a move would erase recent gains, invalidate the bullish thesis, and increase short-term volatility.

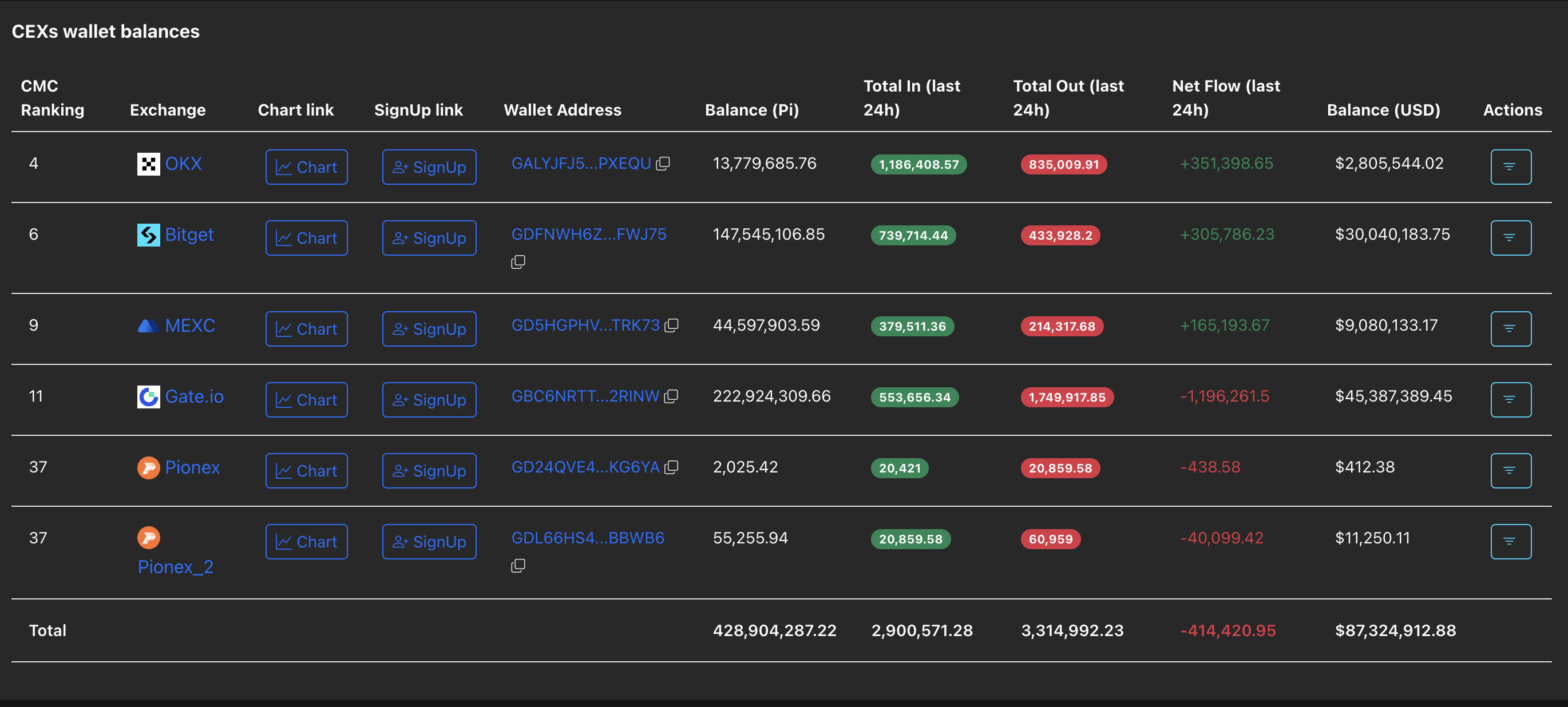

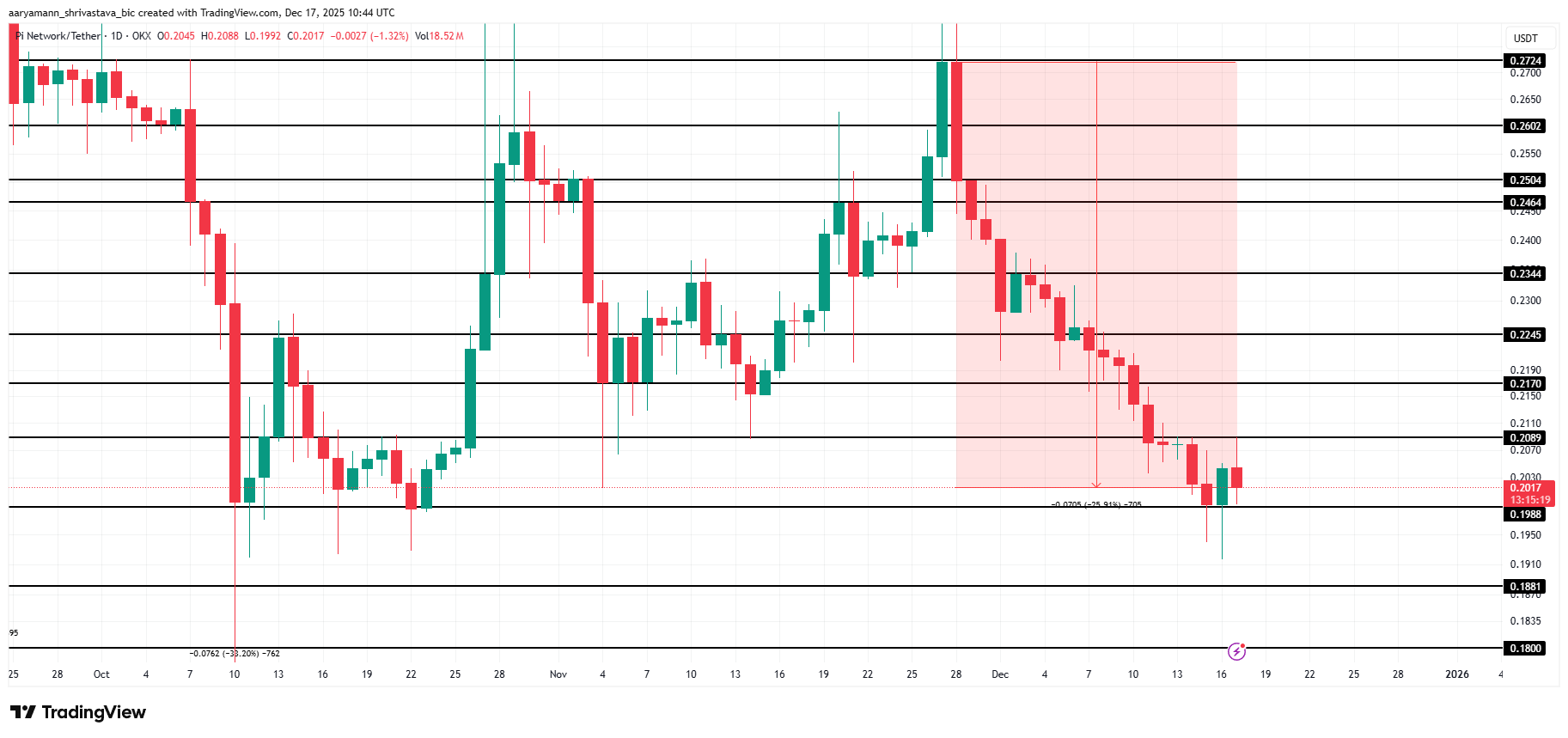

Pump.fun (PUMP)

PUMP has moved opposite to NIGHT, ranking among the worst-performing altcoins this week. The token has fallen more than 35%, trading near $0.00197. Persistent selling pressure reflects weak sentiment, as investors continue reducing exposure amid broader market uncertainty.

Despite losses, technical indicators offer a potential rebound signal. The relative strength index has entered oversold territory, suggesting selling pressure may be exhausting. If buyers step in, PUMP could rebound above $0.00212 and extend gains toward the $0.00242 resistance level.

The recovery scenario remains fragile. Failure to attract buying interest could extend losses. A breakdown below current levels may send PUMP toward the $0.00171 support. Such a move would invalidate the bullish outlook and reinforce continued downside risk.

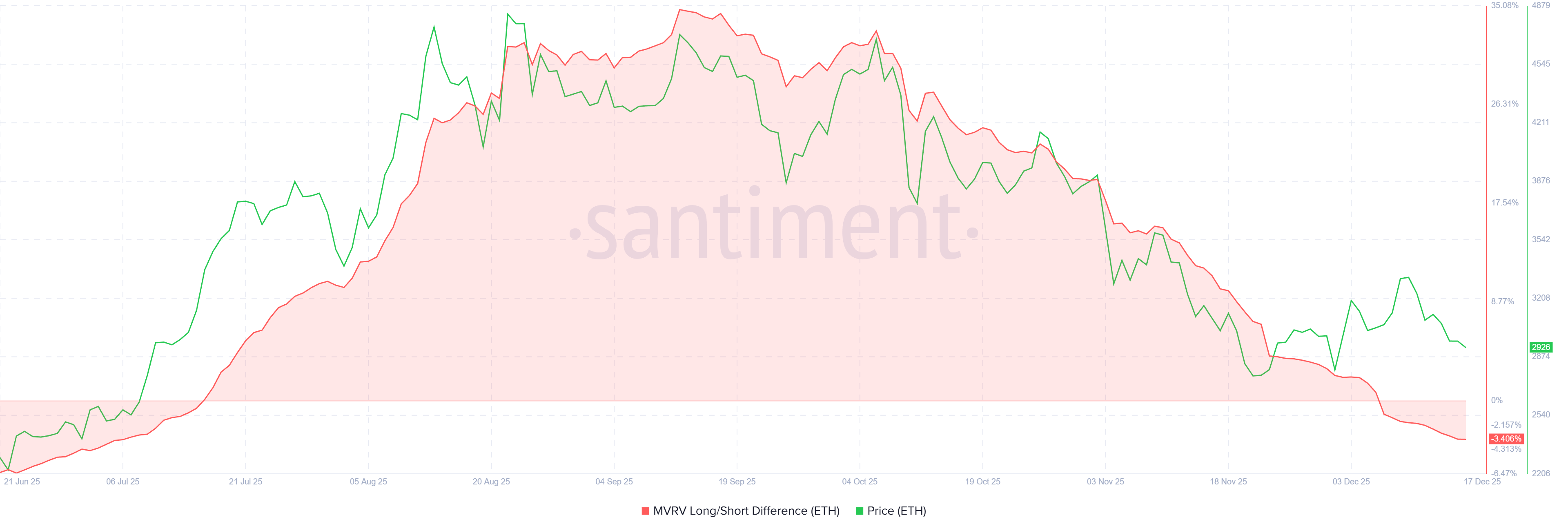

Bitcoin Cash (BCH)

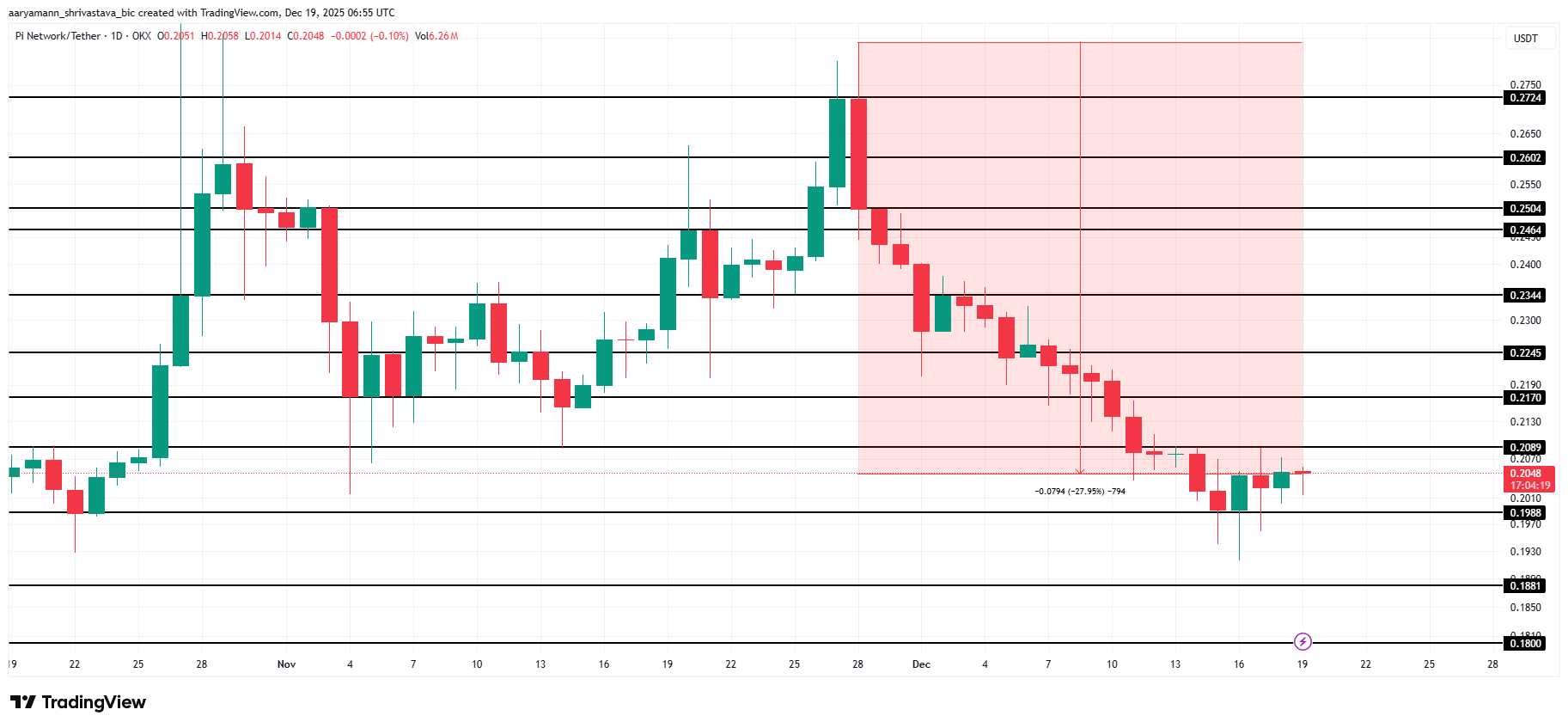

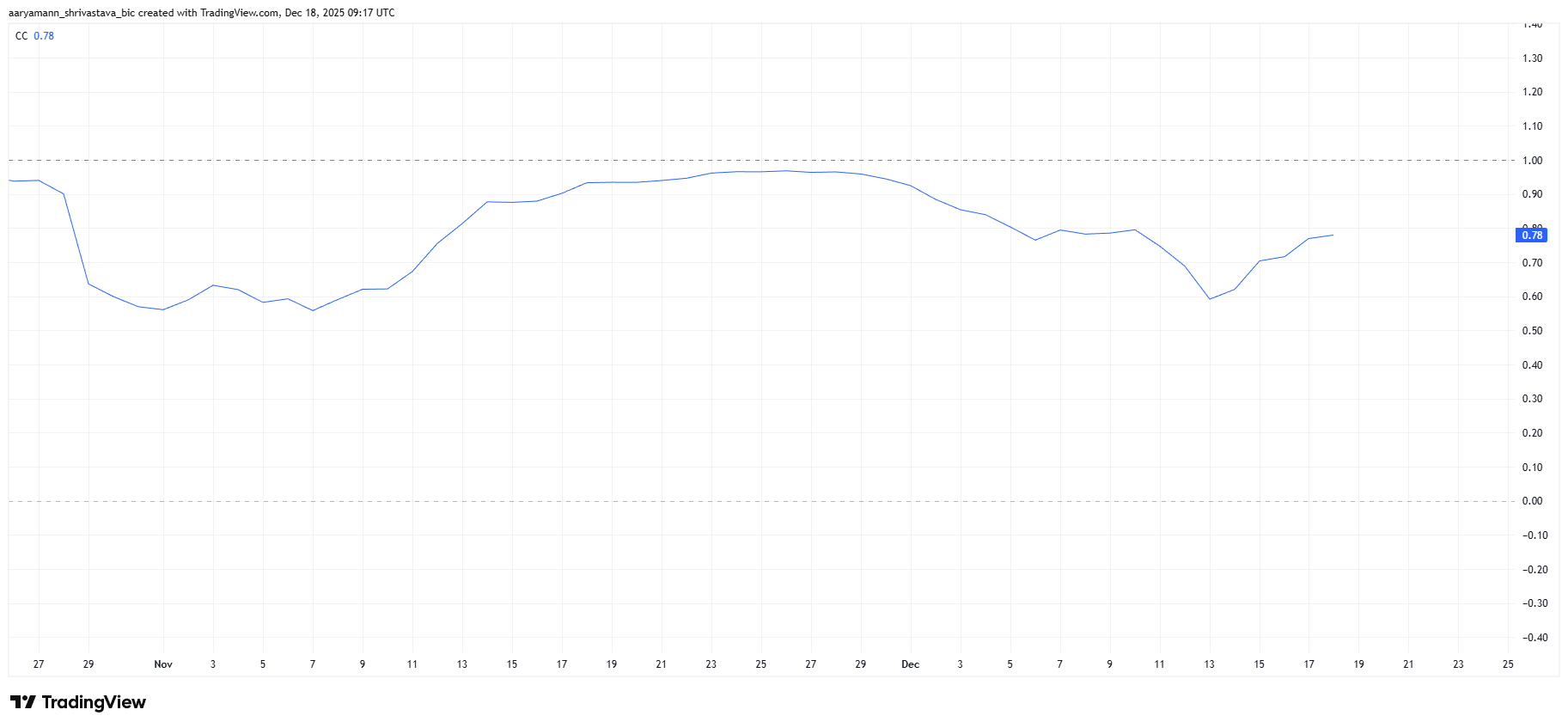

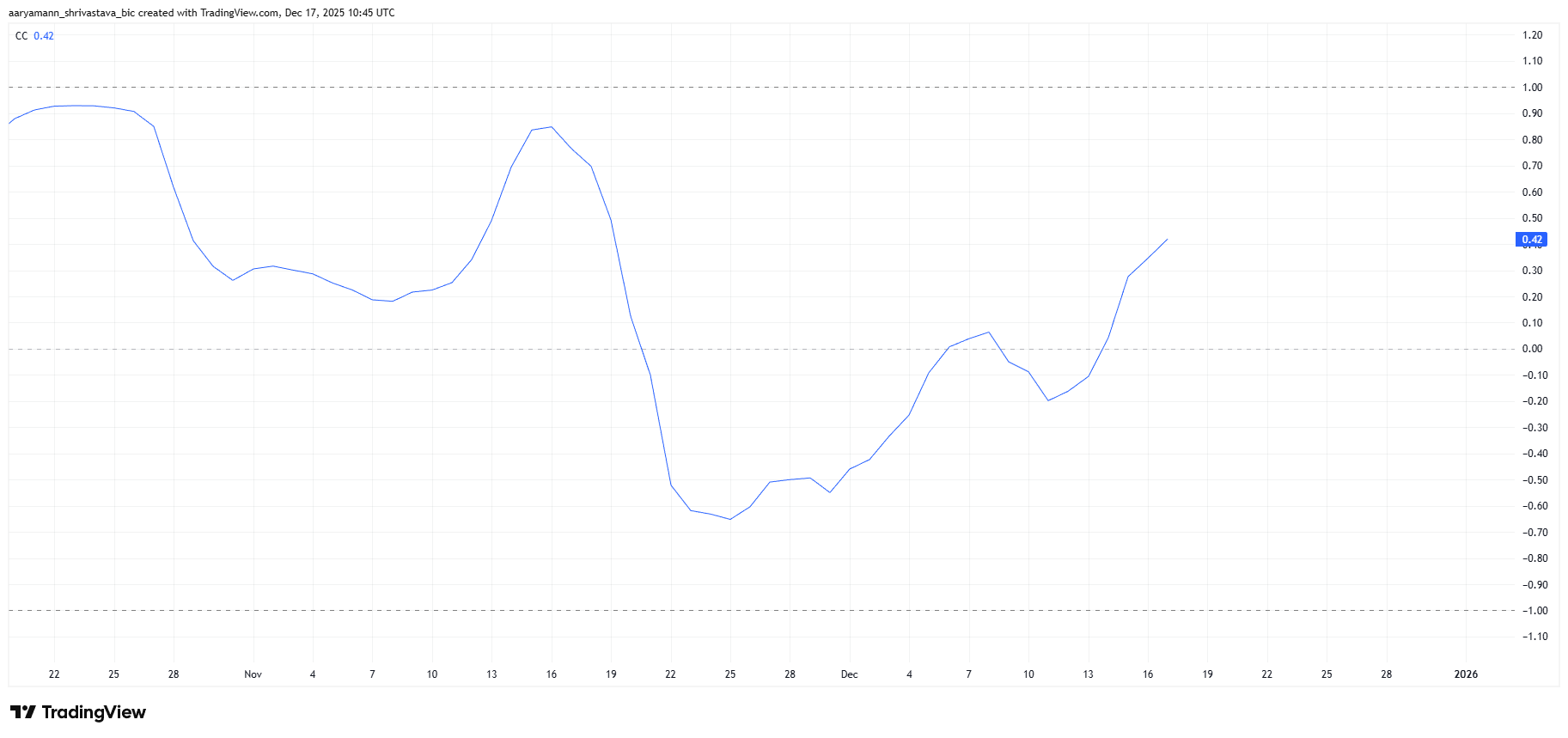

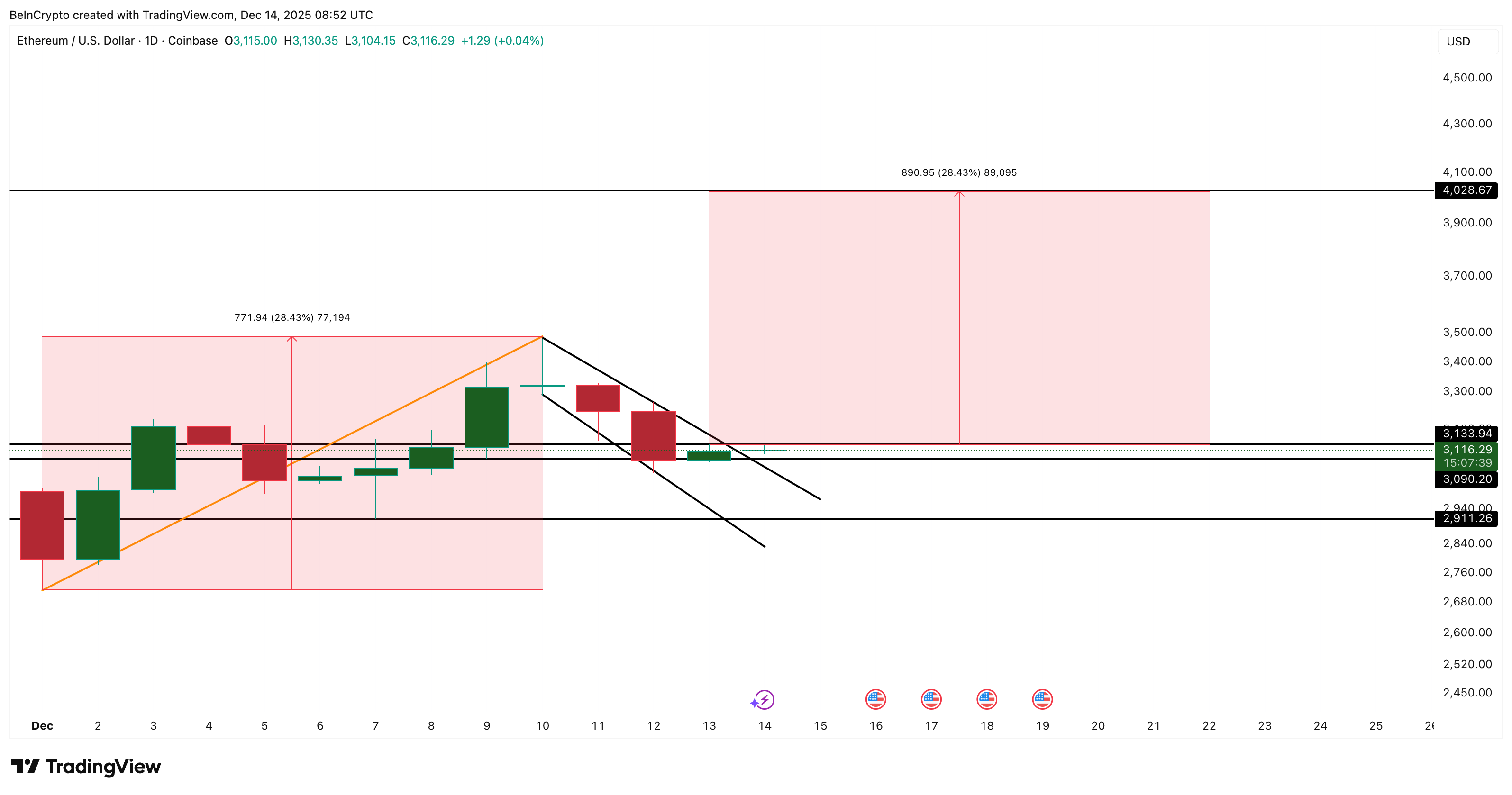

Bitcoin Cash jumped 8% today on asset-specific activity rather than broader Bitcoin moves. The rally followed speculation surrounding ShapeShift founder Erik Voorhees swapping 4,619 ETH, valued at $13.42 million, for 24,950 BCH from a wallet inactive for nine years, reigniting market interest.

However, Erik Voorhees confirmed that the wallet did not belong to him, nor does he own any BCH. Nevertheless, the rally ignited by the speculation may likely extend into the weekend.

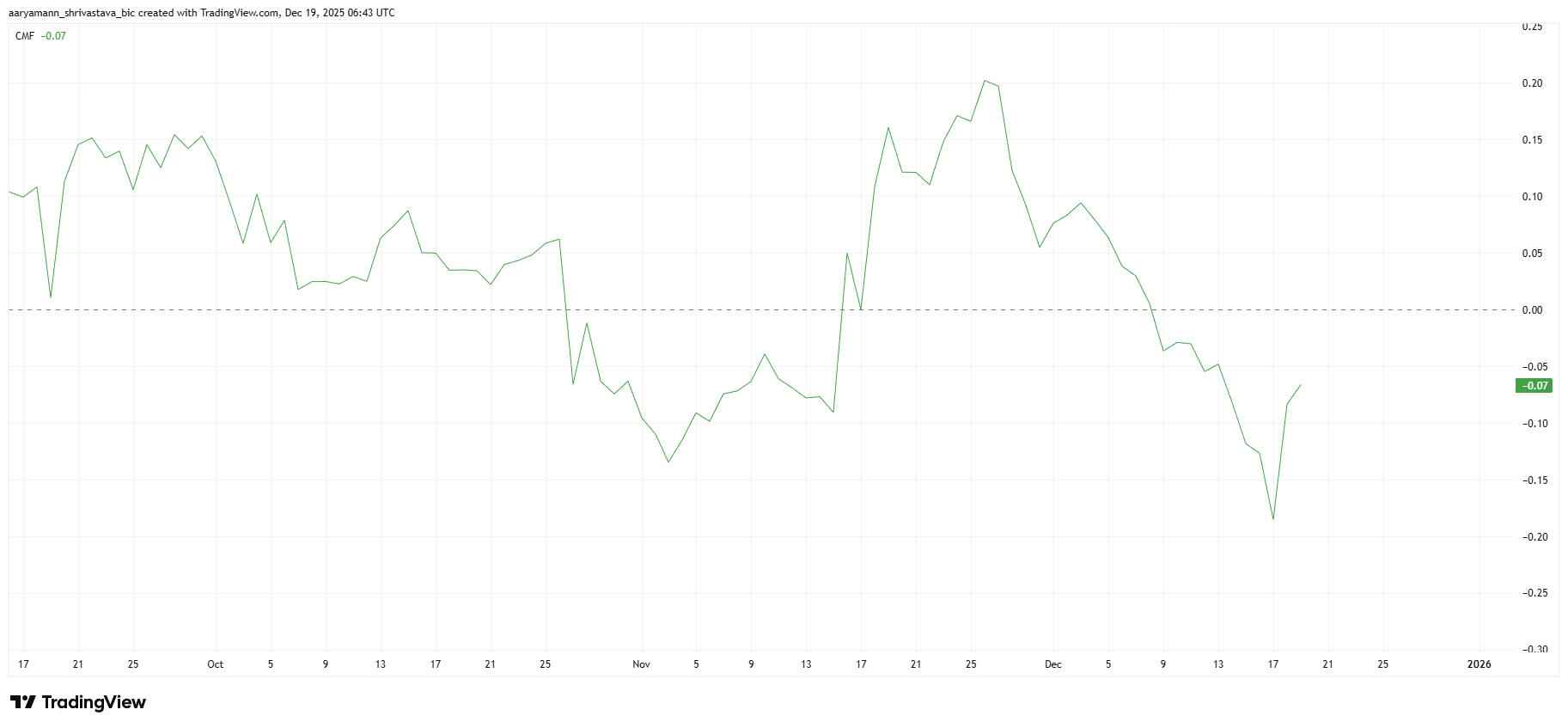

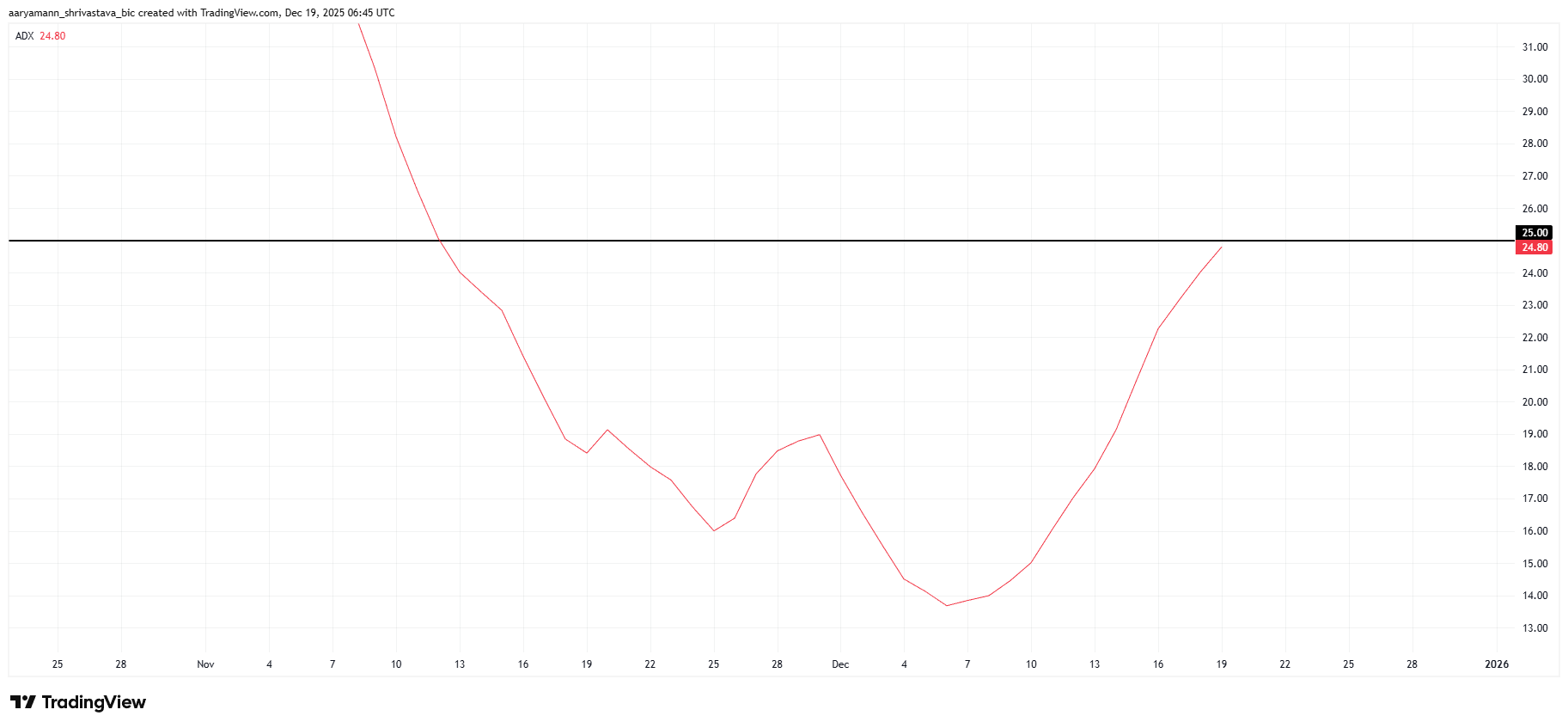

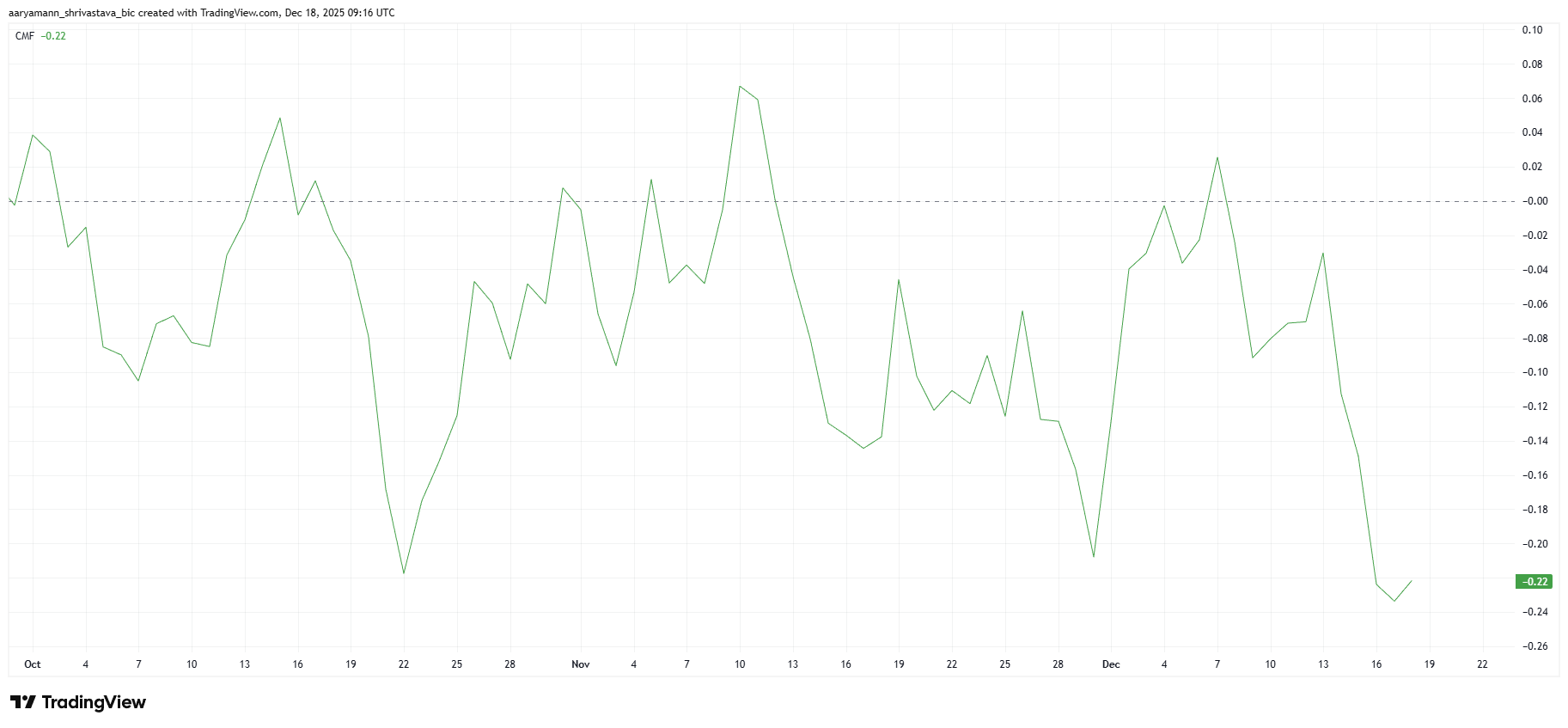

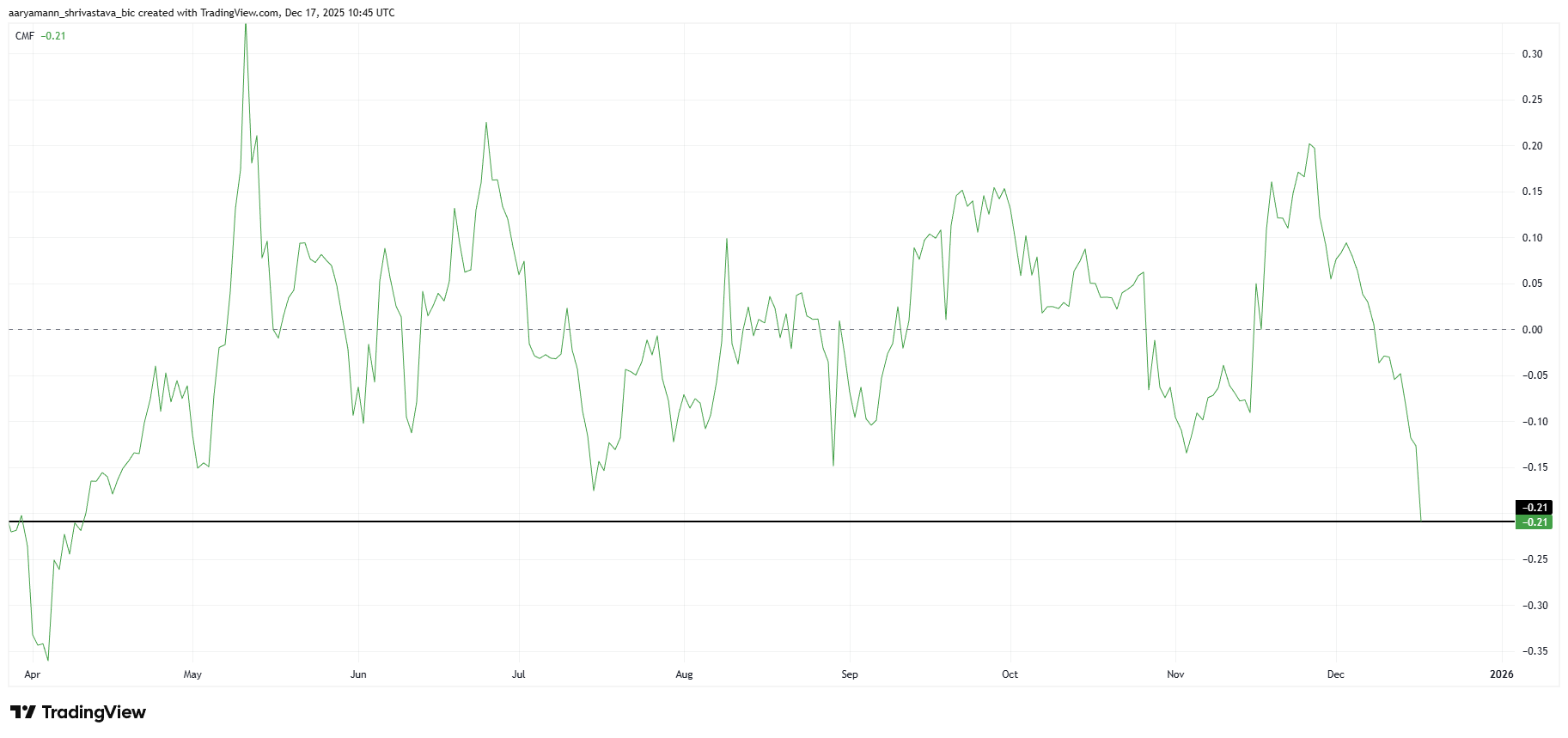

Continued investor inflows, confirmed by a rising Chaikin Money Flow, support the upside case. If demand holds, BCH could break above $593 and advance toward $624, signaling short-term recovery strength driven by renewed confidence.

Downside risks persist if momentum fades. Failure to reclaim $593 could keep Bitcoin Cash capped below $600. In that scenario, weakening demand may pull BCH toward $555 or lower, reinforcing consolidation and invalidating the near-term bullish outlook.

The post 3 Altcoins To Watch This Weekend | December 20 – 21 appeared first on BeInCrypto.