CPI AS di Sorot saat Investor Menimbang Outlook Suku Bunga The Fed Januari

Biro Statistik Tenaga Kerja Amerika Serikat (AS) akan merilis data Consumer Price Index (CPI) yang sangat penting untuk bulan November pada hari Kamis pukul 13:30 GMT.

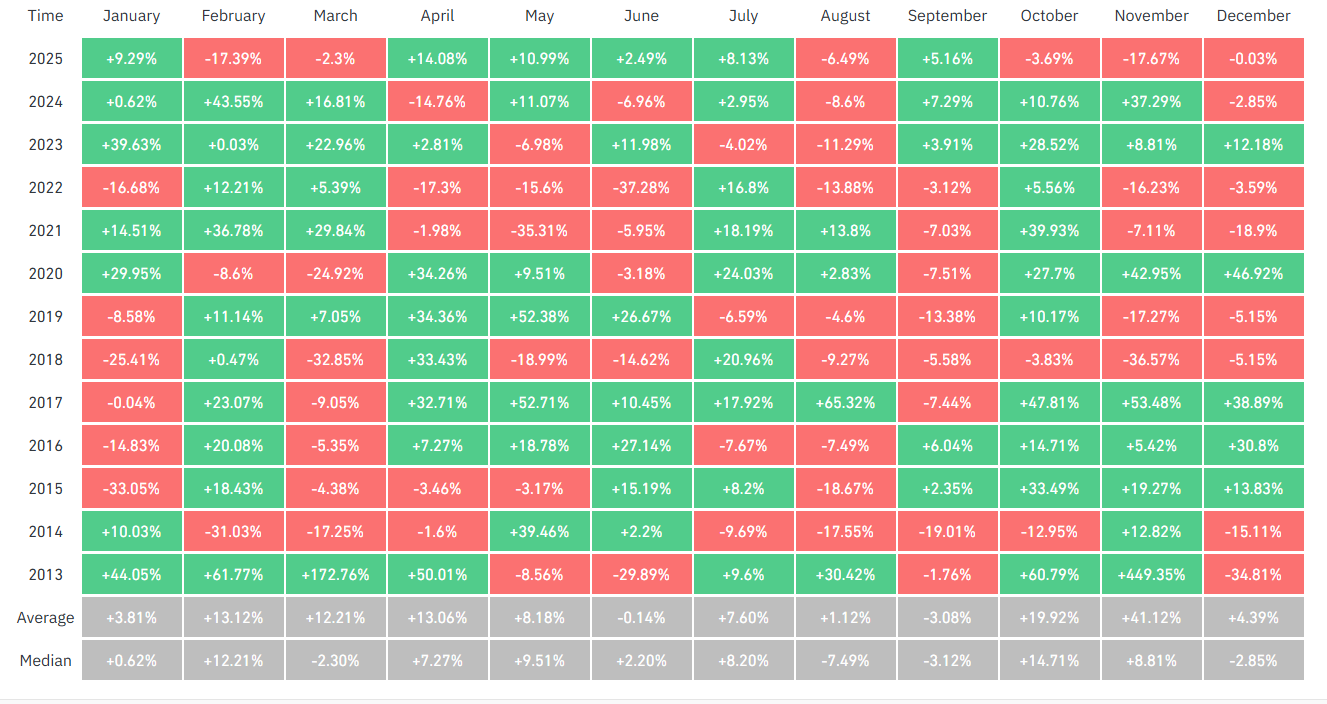

Laporan inflasi ini tidak akan mencantumkan angka CPI untuk Oktober dan juga tidak menyajikan data CPI bulanan untuk November karena tidak ada pengumpulan data selama penutupan pemerintahan. Oleh karena itu, para investor akan memperhatikan data CPI tahunan dan core CPI untuk menilai bagaimana dinamika inflasi bisa memengaruhi prospek kebijakan The Fed ke depan.

Apa yang bisa diharapkan pada laporan data CPI berikutnya?

Berdasarkan perubahan pada CPI, inflasi di AS diperkirakan naik dengan laju tahunan sebesar 3,1% pada bulan November, sedikit di atas angka bulan September. Inflasi core CPI yang tidak termasuk kategori makanan dan energi yang volatil, juga diprediksi meningkat 3% di periode ini.

Analis TD Securities memperkirakan inflasi tahunan akan naik lebih tinggi dari perkiraan, namun melihat inflasi inti tetap stabil.

“Kami memperkirakan CPI AS akan naik 3,2% y/y pada November – laju tercepat sejak 2024. Peningkatannya akan dipicu oleh kenaikan harga energi, sementara kami prediksi core CPI tetap stabil di 3,0%,” terang mereka.

Bagaimana laporan Consumer Price Index AS bisa memengaruhi US$?

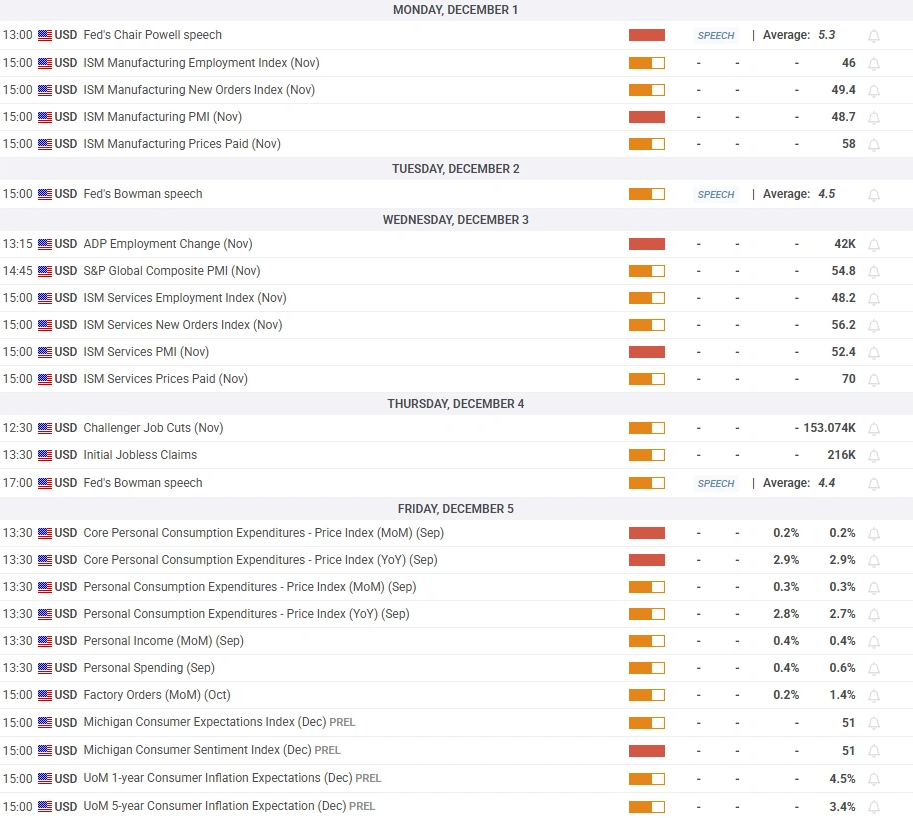

Menjelang pertarungan data inflasi AS pada hari Kamis, investor melihat kemungkinan hampir 20% adanya pemotongan suku bunga The Fed sebesar 25 basis poin di Januari mendatang, menurut alat CME FedWatch.

Laporan ketenagakerjaan resmi BLS yang tertunda menunjukkan pada Selasa bahwa Nonfarm Payrolls turun sebanyak 105.000 di Oktober dan naik sebesar 64.000 di November. Selain itu, Tingkat Pengangguran meningkat menjadi 4,6% dari 4,4% di September. Angka-angka ini tidak mengubah ekspektasi pasar terhadap keputusan The Fed di Januari, sebab penurunan tajam payrolls di Oktober sudah diperkirakan karena hilangnya pekerjaan pemerintah saat penutupan pemerintahan.

Dalam sebuah postingan blog yang dirilis Selasa malam, Presiden The Fed Atlanta Raphael Bostic menyatakan bahwa laporan pekerjaan yang beragam tersebut tidak mengubah prospek kebijakan, dan menambahkan bahwa ada “banyak survei” yang mengindikasikan peningkatan biaya input dan perusahaan bertekad menjaga margin mereka dengan menaikkan harga.

Peningkatan yang nyata, dengan hasil inflasi CPI tahunan sebesar 3,3% atau lebih, bisa memperkuat kebijakan The Fed untuk menahan suku bunga pada Januari dan langsung mendorong US Dollar (USD). Sementara itu, jika inflasi tahunan turun menjadi 2,8% atau lebih rendah, para pelaku pasar bisa mulai memprediksi adanya pemotongan suku bunga The Fed di Januari. Dalam keadaan seperti ini, USD bisa langsung mendapatkan tekanan jual yang cukup berat.

Eren Sengezer, European Session Lead Analyst di FXStreet, membagikan pandangan teknikal singkat untuk US Dollar Index (DXY) dan menguraikan:

“Outlook teknikal jangka pendek menunjukkan bias bearish di USD Index masih bertahan, tapi ada beberapa tanda yang menunjukkan momentum negatif mulai berkurang. Indikator Relative Strength Index (RSI) di grafik harian sudah kembali naik ke atas 40 dan USD Index masih bertahan di atas retracement Fibonacci 50% dari tren naik September-November.”

“Simple Moving Average (SMA) 100-hari berada di level pivot 98,60. Jika USD Index naik di atas level ini dan menegaskannya sebagai support, para penjual teknikal bisa kehilangan kepercayaan. Dalam skenario ini, retracement Fibonacci 38,2% bisa menjadi resistance berikutnya di 98,85 sebelum mencapai area 99,25-99,40, tempat di mana terdapat SMA 200-hari dan retracement Fibonacci 23,6%.”

“Pada sisi bawah, level retracement Fibonacci 61,8% berada di 98,00 sebagai support utama sebelum ke 97,40 (retracement Fibonacci 78,6%) dan 97,00 (angka bulat).”