Tom Lee Temukan Sinyal Besar Ethereum di Tengah Dorongan Tokenisasi JPMorgan | US Crypto News

Selamat datang di US Crypto News Morning Briefing—ringkasan penting perkembangan dunia aset kripto paling utama untuk hari ini.

Ambil secangkir kopi, karena Wall Street baru saja memberikan sinyal lain bahwa masa depan kripto makin bersifat institusional. Ketika JPMorgan membawa salah satu produk keuangan intinya ke dalam chain, para pengamat pasar mulai bertanya-tanya apakah ini sekadar percobaan atau perubahan yang lebih dalam menuju Ethereum sebagai infrastruktur ekonomi.

Berita Kripto Hari Ini: JPMorgan Bawa Pasar Uang ke On-Chain dengan Fund Berbasis Ethereum

JPMorgan Chase kembali mengambil langkah tegas di dunia keuangan berbasis blockchain, dengan meluncurkan exchange-traded fund (ETF) pasar uang ter-tokenisasi pertamanya di jaringan Ethereum.

Menurut laporan WSJ, divisi manajemen aset raksasa perbankan ini yang mengelola US$4 triliun telah merilis My OnChain Net Yield Fund atau MONY. Produk ini merupakan private money market fund yang berjalan di Ethereum dan didukung oleh platform tokenisasi milik JPMorgan, yakni Kinexys Digital Assets.

Bank tersebut akan memodali fund ini dengan US$100 juta dari dana mereka sendiri sebelum membukanya untuk investor eksternal, yang menandakan keyakinan internal yang kuat terhadap produk keuangan berbasis tokenisasi.

JPMORGAN STEPS FURTHER INTO CRYPTO WITH TOKENIZED MONEY FUND

— Evan (@StockMKTNewz) December 15, 2025

The banking giant’s $4 trillion asset-management arm is rolling out its first tokenized money-market fund on the Ethereum blockchain. JPMorgan will seed the fund with $100 million of its own capital, and then open it… pic.twitter.com/TTlS5E1MyV

MONY khusus dibuat untuk partisipasi institusi dan individu dengan kekayaan tinggi saja. Fund ini terbuka untuk investor yang memenuhi syarat, termasuk individu dengan setidaknya US$5 juta aset investable dan institusi dengan minimum US$25 juta, serta investasi minimum sebesar US$1 juta.

Investor akan menerima token digital yang mewakili kepemilikan mereka dalam fund ini, yang membawa eksposur pasar uang tradisional ke blockchain sembari tetap menjaga pola imbal hasil yang sudah dikenal.

Berdasarkan laporan tersebut, eksekutif JPMorgan menyebut bahwa permintaan dari klien menjadi pendorong utama peluncuran ini.

“There is a massive amount of interest from clients around tokenization,” baca kutipan dalam laporan itu, mengutip John Donohue, kepala global liquidity di JPMorgan Asset Management.

Ia menambahkan bahwa mereka berharap bisa jadi pemimpin di bidang ini dengan menawarkan produk pasar uang tradisional versi berbasis blockchain.

Peluncuran ini terjadi di tengah momentum makin kencang tokenisasi aset di Wall Street, seiring dengan disahkannya GENIUS Act pada awal tahun ini.

Undang-undang tersebut menetapkan kerangka regulasi stablecoin di AS dan dianggap sebagai pendorong utama upaya tokenisasi yang lebih luas pada fund, obligasi, dan aset dunia nyata lainnya.

Sejak saat itu, institusi keuangan besar bergerak cepat untuk mengeksplorasi blockchain sebagai infrastruktur inti pasar, bukan sekadar eksperimen sampingan.

Bagi Ethereum, keputusan JPMorgan untuk meluncurkan MONY di jaringan ini dipandang sebagai bentuk dukungan institusional yang signifikan. Co-founder Fundstrat, Tom Lee, menanggapi kabar ini dengan menyebut bahwa langkah tersebut “bullish for ETH.”

This is bullish for $ETH https://t.co/LdGMHYKM9P

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) December 15, 2025

Komentar tersebut menunjukkan bagaimana produk seperti MONY memperluas kegunaan Ethereum di dunia nyata melalui aktivitas transaksi, eksekusi smart contract, serta integrasi lebih dalam dengan sektor keuangan global.

Pemerhati kripto pun sependapat, dengan beberapa di antara mereka berpendapat bahwa peran Ethereum sebagai layer settlement untuk produk keuangan yang sudah teregulasi jadi semakin sulit diabaikan.

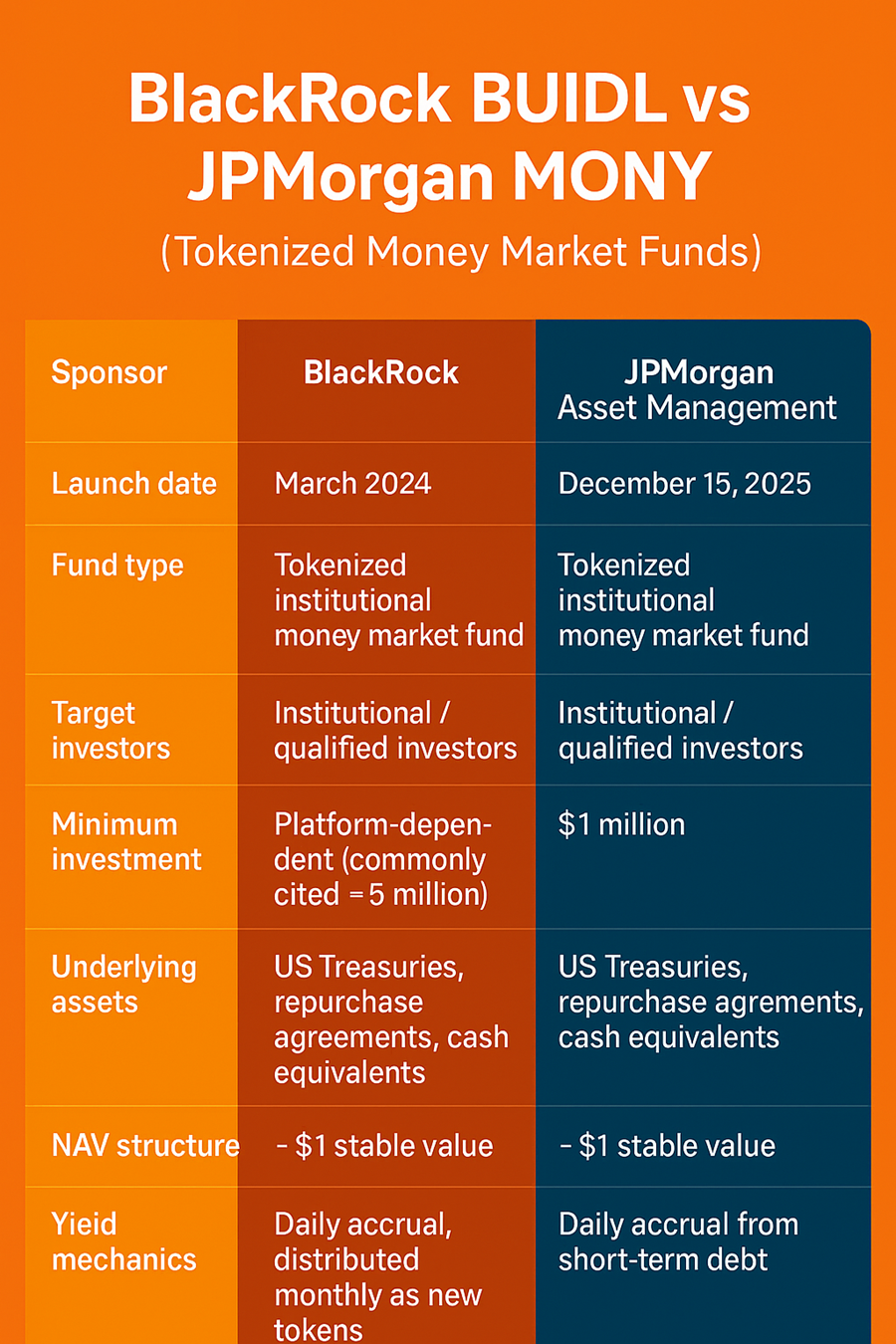

JPMorgan vs BlackRock: Tokenized Money Market Fund Tanda Era Baru di Dunia Keuangan

Langkah JPMorgan juga mengundang perbandingan dengan tokenized money market fund milik BlackRock, yaitu BUIDL, yang kini aset kelolaannya sudah tumbuh sekitar US$1,83 miliar menurut data blockchain publik.

Sama seperti MONY, BUIDL juga berinvestasi di US Treasury jangka pendek, repo, dan instrumen setara kas. Namun, BUIDL menganut strategi lintas chain dan bekerja sama dengan mitra tokenisasi yang berbeda.

Keberadaan dua fund ini semakin menyoroti tren besar di mana perusahaan tradisional finance (TradFi) mulai terjun ke blockchain untuk memodernisasi produk-produk penghasil imbal hasil berisiko rendah.

Secara lebih luas, analis melihat tokenisasi sebagai cara bagi produk money market tradisional tetap bisa bersaing dengan stablecoin, sekaligus membuka beragam use case baru seperti settlement di chain, programmable, hingga transferabilitas yang lebih baik.

JPMorgan sudah lebih dulu menjajal tokenized deposit, private equity fund, dan token pembayaran institusional, yang menunjukkan bahwa MONY merupakan bagian dari strategi jangka panjang, bukan sekadar uji coba sesaat.

Seiring regulasi makin jelas dan partisipasi institusi semakin dalam, fund JPMorgan berbasis Ethereum semakin mempertegas cerita bahwa blockchain—yang dulu hanya dianggap khusus—perlahan makin jadi bagian penting dari sistem keuangan modern.

Bagi Ethereum, perubahan ini mungkin menjadi salah satu sinyal paling besar dan menentukan selama ini.

Chart Hari Ini

Byte-Sized Alpha

Berikut rangkuman berita aset kripto terbaru di Amerika Serikat yang patut diperhatikan hari ini:

- Russell 2000 catat rekor tertinggi baru, menyalakan kembali pola Bitcoin yang sudah dikenal.

- Satu level harga XRP penting muncul — Menjaganya bisa picu lonjakan 9%.

- 3 prediksi harga teratas: Bitcoin, emas, dan perak menandakan titik balik penting.

- Apa arti kesenjangan investor saham dan aset kripto untuk masa depan?

- Pencipta Base Jesse Pollak dapat reaksi keras setelah dukung meme token yang terhubung Soulja Boy.

- Apakah Bitcoin kehilangan dukungan whale? Tapi data sejarah menunjukkan harga masih bisa naik.

- Yuan sentuh level tertinggi 14 bulan karena perbedaan arah kebijakan Fed-BOJ-PBOC — dampak untuk kripto.

- Coinbase CLO Paul Grewal: Kisah SEC kripto versi NYT tidak ungkap pelanggaran—Lalu apa tujuan judul tersebut?

Gambaran Umum Pre-Market Crypto Equities

| Perusahaan | Penutupan 12 Desember | Ringkasan Pre-Market |

| Strategy (MSTR) | US$176,45 | US$176,75 (+0,17%) |

| Coinbase (COIN) | US$267,46 | US$268,40 (+0,35%) |

| Galaxy Digital Holdings (GLXY) | US$26,75 | US$26,75 (0,00%) |

| MARA Holdings (MARA) | US$11,52 | US$11,56 (+0,35%) |

| Riot Platforms (RIOT) | US$15,30 | US$15,31 (+0,065%) |

| Core Scientific (CORZ) | US$16,53 | US$16,65 (+0,73%) |