Biar Live Streaming TikTok Makin Ramai, Begini Cara Optimalkan Algoritma

Live streaming di TikTok memerlukan algoritma untuk meningkatkan jangkauan. Diversifikasi konten dan interaksi aktif kunci sukses menarik audiens.

Live streaming di TikTok memerlukan algoritma untuk meningkatkan jangkauan. Diversifikasi konten dan interaksi aktif kunci sukses menarik audiens.  Live streaming di TikTok memerlukan algoritma untuk meningkatkan jangkauan. Diversifikasi konten dan interaksi aktif kunci sukses menarik audiens.

Live streaming di TikTok memerlukan algoritma untuk meningkatkan jangkauan. Diversifikasi konten dan interaksi aktif kunci sukses menarik audiens.  Telkomsel raih tiga penghargaan di Glotel Awards 2025, mempertahankan prestasi tiga tahun berturut-turut. Inovasi teknologi mendukung konektivitas di Indonesia.

Telkomsel raih tiga penghargaan di Glotel Awards 2025, mempertahankan prestasi tiga tahun berturut-turut. Inovasi teknologi mendukung konektivitas di Indonesia.  Hari Natal selalu identik dengan Sinterklas yang terbang membagikan hadiah. Yuk cek posisi terbang Santa dengan aplikasi Flightradar24.

Hari Natal selalu identik dengan Sinterklas yang terbang membagikan hadiah. Yuk cek posisi terbang Santa dengan aplikasi Flightradar24. As 2025 winds down, stablecoins like USDC are being used for more than just trading. They are increasingly part of payments, business transfers, and routine movement of funds, not only activity tied to market cycles. As more money moves more often, the way those transfers settle has started to matter far more than it used to.

That change has put pressure on existing blockchain networks. Activity picked up over the second half of the year, and during busy periods this showed up through higher fees, slower confirmations, and less predictable transfer costs.

On Ethereum, for example, sending USDC late in 2025 has often cost anywhere from a few dollars to well over ten dollars during periods of congestion, meaning even a basic transfer can end up costing more than expected.

By the second half of the year, fee volatility had become another familiar issue. Gas-based pricing means the cost of a stablecoin transfer can change quickly depending on network conditions, making routine payments harder to plan for traders, businesses, and treasury teams. In practice, once exchange and transfer fees are factored in, the cost advantage of using stablecoins can narrow more than many users expect.

That’s where Bybit’s decision to add USDC support on the XDC Network fits in. As stablecoin transfers become part of everyday activity, exchanges are under pressure to offer routes that are easier to manage and more predictable. How quickly and cheaply funds can move now matters as much as access itself.

“Most users don’t care about blockchain labels anymore. They care about whether a transfer clears quickly and what it costs them in the end,” said Angus O’Callaghan, head of trading and markets at XDC Network. “If stablecoins are going to function as everyday financial tools, the infrastructure underneath them has to feel reliable, not stressful.”

For most stablecoin users, access isn’t the problem anymore. USDC is already available on nearly every major exchange. What people care about now is whether moving funds actually works the way they need it to: quickly, regularly, and without having to think twice about the cost.

Bybit’s recent changes make sense within this context. Alongside opening another route for USDC transfers, the exchange is waiving withdrawal fees on XDC from December 1, 2025 through January 1, 2026, and offering a 200,000 USDC reward pool for new users who register and make qualifying deposits.

From a user point of view, this is less about features and more about convenience. When transfers start to feel expensive or unpredictable, people naturally change how they move money. Some wait longer to transfer, others batch payments, and some avoid smaller transactions altogether. Having another option available makes those decisions easier.

For Bybit users, USDC on XDC simply adds flexibility. It gives them another way to move funds when the usual routes don’t feel like the best choice, without changing what they’re using or how they think about stablecoins.

Bybit’s recent move around USDC transfers reflects a change that’s starting to show up across the exchange landscape. While Bybit has taken a clear step in expanding how users can move funds, it’s also part of a wider pattern playing out over the past few weeks.

BTSE, KuCoin, MEXC, Gate.io, Bitrue, and Pionex have also expanded support for XDC, enabling deposits, withdrawals, and trading. Taken together, these moves point to growing interest among exchanges in settlement networks that can handle regular transfer activity without the fee swings seen on more congested chains.

For exchanges, the reasoning is largely practical. As stablecoin flows increase, relying on a small set of networks can make platforms more exposed to sudden cost changes and slower settlement during peak periods. Adding alternative routes gives exchanges more flexibility, helps smooth out those pressures, and offers users more consistent ways to move funds without changing the assets they already use.

All of this is also happening as stablecoins start to be treated more like real payment tools. In the U.S., proposals such as the GENIUS Act are focused on putting clearer rules around how stablecoins are issued and used, especially for payments and institutional activity. As that happens, the way stablecoins move between platforms and networks becomes more than a technical detail and part of what users and institutions expect by default.

“When stablecoins start getting used outside of trading, the conversation changes,” O’Callaghan added. “Once there are clearer rules around how they’re meant to work, like what’s being discussed with the GENIUS Act, people stop treating transfers as experiments. They expect them to behave like regular payments: to go through on time, at a cost they can understand, and without needing to second-guess every move.”

XDC Network is mostly used for practical, behind-the-scenes work rather than consumer-facing crypto activity. It’s been used in areas like trade finance, real-world asset tokenization, and settlement processes where systems need to work consistently and without surprises.

That same setup also works well for moving stablecoins. Transfers on XDC tend to go through quickly and usually cost very little, which matters more now that stablecoin transfers became more common. For people or businesses sending USDC often, lower and more predictable costs make those transfers easier to manage over time.

This is starting to show in the data. The amount of USDC issued on XDC has continued to rise and recently passed $200 million, indicating that usage is moving beyond early tests and into more regular activity. Rather than brief spikes, the numbers point to steady use by participants who move funds often.

Image source: USDC.COOL

From XDC’s side, integrations like Bybit’s are mainly about being useful. The network is being used as another place where stablecoin transfers can happen reliably, rather than as something meant to attract attention on its own.

XDC was also designed with institutional payment flows in mind, where predictable settlement and consistent costs matter more than short-term optimization. That makes it practical for businesses and financial institutions moving stablecoins at scale, where delays or sudden fee swings quickly turn into operational problems.

That focus is already showing up in how the network is being used. Beyond basic transfers, XDC supports more complex financial workflows, including global payments, tokenized settlement, and stablecoin-based liquidity. Assets like USDC are increasingly used within these flows, including as collateral, and more than $500 million worth of assets have already been tokenized and settled on the network.

Image source: TradeFi Network

This kind of activity is especially relevant for trade finance and cross-border settlement, where funds need to move reliably across jurisdictions rather than fluctuate with market conditions. As more payment and trade processes move on-chain, infrastructure that can handle steady, high-volume transfers becomes less of a nice-to-have and more of a requirement.

In the end, decisions like Bybit’s USDC support on XDC are not about any single network or promotion and more about how exchanges are adjusting to a maturing market. For the exchange, offering another way to move USDC is part of that adjustment – making sure the experience holds up not just during quiet periods, but when activity picks up and small frictions start to matter. XDC’s role in that setup reflects how infrastructure choices are becoming part of the exchange’s responsibility, even if they stay largely out of sight.

“Good infrastructure doesn’t draw attention to itself,” O’Callaghan concludes. “When it works properly, users barely think about it, and that’s usually the goal.”

The post USDC Is Being Used for More Than Trading, and Bybit Is Expanding Support on XDC appeared first on BeInCrypto.

Wakil Menteri Nezar Patria apresiasi pemulihan jaringan TelkomGroup di Aceh Tamiang pascabencana. Konektivitas penting untuk pemulihan ekonomi lokal.

Wakil Menteri Nezar Patria apresiasi pemulihan jaringan TelkomGroup di Aceh Tamiang pascabencana. Konektivitas penting untuk pemulihan ekonomi lokal. Harga Bitcoin kini berada di kisaran $87.700 atau sekitar Rp1,46 miliar, jauh lebih rendah dibandingkan puncaknya di bulan Oktober lalu. Investor kini mulai mempertanyakan kembali posisi Bitcoin sebagai “emas digital”, terutama di tahun 2025 yang dipenuhi ketegangan geopolitik dan preferensi investasi defensif.

Di saat Bitcoin mencatat penurunan sekitar 6% sejak awal tahun, emas justru melesat hingga 70%. Perbedaan performa ini bukan sekadar statistik, melainkan sinyal kuat bahwa pelaku pasar lebih memilih aset fisik yang dianggap lebih stabil sebagai perlindungan nilai.

Lingkungan makro sejak Oktober telah berubah drastis, tidak lagi mendukung Bitcoin. Dari level tertinggi sekitar $126.272, BTC kini tertekan sekitar 30–31% hingga berada di kisaran $87.760. Di sisi lain, harga emas justru naik dari $3.860 menjadi $4.480 atau sekitar Rp74,9 juta, meningkat sekitar 16%.

Perbedaan ini mencerminkan pergeseran minat ke instrumen lindung nilai tradisional, apalagi ketika likuiditas menyusut dan ketidakpastian ekonomi meningkat. Kenaikan imbal hasil riil di AS juga menambah tekanan terhadap aset berisiko yang tidak memberikan yield, seperti Bitcoin.

Data arus dana dari Deutsche Bank memperkuat narasi ini. Produk investasi berbasis Bitcoin terus mencatatkan outflow sepanjang November dan Desember. Sebaliknya, ETF berbasis emas justru mencatatkan inflow stabil.

Walau begitu, data on-chain menunjukkan bahwa investor ritel tidak mengalami kapitulasi besar. Distribusi wallet kecil tetap stabil, artinya pelemahan ini lebih banyak disebabkan oleh rotasi portofolio institusional dan aktivitas derivatif, bukan aksi jual panik dari investor individu.

Secara keseluruhan, pasar sedang melakukan repricing terhadap Bitcoin secara makro, membuatnya kini semakin bergantung pada kebijakan moneter dan ketersediaan likuiditas ketimbang sekadar narasi spekulatif.

Secara teknikal, prospek harga Bitcoin masih cenderung bearish. Harga saat ini masih bergerak dalam channel menurun pada grafik 2 jam, setelah gagal menembus resistance di $94.600. Support jangka pendek berada di zona $86.500–$86.700. Struktur candlestick yang terbentuk, spinning top dan body kecil mengisyaratkan konsolidasi, bukan tekanan jual agresif.

EMA 50 berada di sekitar $87.750 sementara EMA 100 di $87.980 masih menjadi batas resistensi terdekat. Jarak antar keduanya mulai menyempit, menandakan adanya keseimbangan antara tekanan beli dan jual.

RSI yang berada di kisaran 52 mulai membentuk higher low, mengindikasikan adanya divergensi bullish, meskipun harga masih terjebak dalam rentang konsolidasi. Channel yang terbentuk mulai menyerupai pola falling wedge, yang biasanya berakhir dengan breakout ke atas ketika tekanan jual mulai mereda.

Breakout di atas $88.800 bisa menjadi pemicu untuk pemulihan menuju $90.600, bahkan hingga $92.700. Namun jika support $86.500 gagal dipertahankan, risiko penurunan ke $83.800 hingga $81.600 akan terbuka lebar.

Meskipun Bitcoin tidak lagi menjadi pilihan utama sebagai lindung nilai, pola kompresi harga ini menunjukkan bahwa pergerakan besar akan segera terjadi. Apakah itu menjadi tanda kembalinya kepercayaan atau justru penyesuaian harga yang lebih dalam, akan sangat memengaruhi arah pasar crypto di awal tahun 2026.

Sementara BTC menghadapi konsolidasi dan penurunan minat institusional, proyek meme coin seperti Pepenode (PEPENODE) justru mulai menarik perhatian. Token ini menggabungkan budaya meme dengan fitur interaktif melalui ekosistem mine-to-earn yang unik. Presale PEPENODE telah mengumpulkan lebih dari $2,3 juta atau sekitar Rp38,5 miliar, dan kini memasuki fase akhir sebelum distribusi token dimulai.

PEPENODE menghadirkan sistem virtual mining berbasis dashboard visual. Pengguna dapat membangun server digital, mengatur node mining, dan memperoleh reward yang disimulasikan. Sistem ini tidak hanya mengusung konsep staking, tetapi juga menawarkan leaderboard dan insentif tambahan pasca peluncuran guna menjaga keterlibatan komunitas.

Presale crypto ini juga menawarkan staking, memberikan kesempatan kepada pembeli awal untuk mengamankan imbal hasil tinggi sebelum token resmi meluncur. Saat ini, harga 1 $PEPENODE adalah $0.0012112 dengan alokasi presale yang semakin menipis.

Bagi investor yang ingin masuk lebih awal ke dalam proyek ini, segera pelajari cara beli PEPENODE melalui laman resmi mereka. Jangan lupa ikuti akun X (Twitter) dan Telegram resmi PEPENODE untuk mendapatkan pembaruan, pengumuman roadmap, dan informasi seputar prediksi harga PEPENODE menjelang listing publik.

Beli PEPENODE di Sini.

The post Prediksi Harga Bitcoin: BTC Turun ke $87.000 Sementara Emas Naik 70% Sepanjang 2025 appeared first on Cryptonews Indonesia.

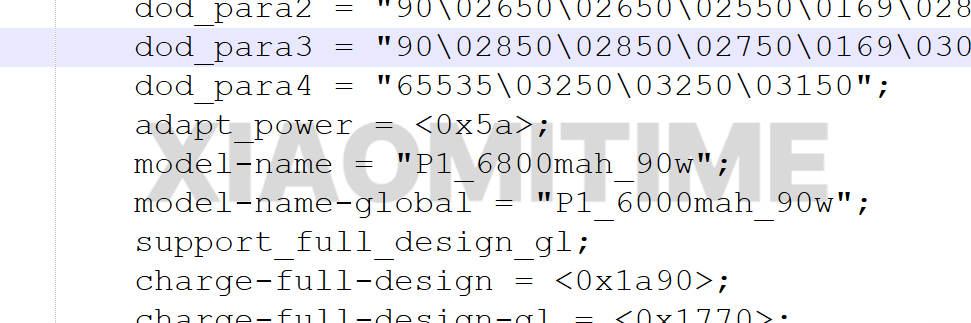

According to new information pulled from MI code, the company is working on the global version of the Xiaomi 17 Ultra, which comes with a significant hardware change compared to the China-exclusive model. Specifically, the global variant will pack a smaller battery. Going by history, this move does not come as a surprise since Xiaomi often employs such tactics during global launches, although this change doesn’t impact the core positioning of the device in terms of performance.

The most crucial difference between the two versions, however, is their battery size: although the Xiaomi 17 Ultra hits the Chinese market with a 6,800 mAh battery, its global counterpart will reportedly come with a 6,000 mAh unit. Looking at that, such a cut seems related more to different regional certification requirements and some internal design changes rather than cost-cutting measures.

Even with the smaller battery, Xiaomi is not changing the charging technology. The global Xiaomi 17 Ultra will also support 90W wired fast charging, which ensures its competitive charging times and maintains the premium user experience as expected from the Ultra series.

Besides the battery adjustment, everything else remains mostly uniform across regions. The Xiaomi 17 Ultra will likely be very focused on camera performance, carrying the baton of Xiaomi’s Ultra line of thought.

Expected camera setup includes:

It will be powered by the Snapdragon 8 Elite Gen 5 processor, making the Xiaomi 17 Ultra one of the most powerful Android smartphones in its class. It is expected that memory and storage options for the device will remain mostly identical through different markets.

Prices could change with the rising memory and component costs. The pricing for the Xiaomi 17 Ultra could go up by 500–1000 yuan, or around $70–$140 USD, in China. Given that these prices are based on information from China, global pricing has not yet been confirmed.

Historically, Xiaomi adjusts global pricing based on taxes, logistics, and regional market conditions. The battery reduction does not necessarily indicate a lower market positioning but more of strategic regional adaptation.

The LOB development (also known as the master budget) and the strategic budget are combined to form the comprehensive budget or master budget.

Mata uang Cina capai level tertinggi dalam 2,5 tahun seiring melemahnya dolar AS — sebuah setup bullish klasik untuk Bitcoin yang ternyata belum berjalan.

Yuan onshore Cina ditutup di level terkuat sejak Mei 2023 pada hari Kamis, diperdagangkan di 7,0066 per dolar AS dan hampir menembus level psikologis 7 per dolar. Penguatan ini menutup apresiasi sebesar 5% terhadap dolar AS sejak awal April.

Reli ini didorong oleh para eksportir Cina yang bergegas menukar pendapatan dolar AS mereka ke yuan sebelum akhir tahun. Hal ini bukan sekadar rutinitas musiman — analis memperkirakan lebih dari US$1 triliun dana korporasi dalam bentuk dolar yang disimpan di luar negeri bisa saja kembali masuk ke Cina nantinya.

Mengapa terjadi sekarang? Perhitungannya sudah berubah. Ekonomi Cina mulai menunjukkan tanda pemulihan, The Fed di AS telah memangkas suku bunga, dan nilai yuan sendiri menguat — menciptakan siklus yang saling memperkuat. Menyimpan dana dalam bentuk dolar AS jadi kurang menarik ketika mata uang yang jadi tujuan konversi terus naik nilainya.

Beberapa broker yakin ini baru permulaan. Tekanan yang selama bertahun-tahun membebani yuan — seperti ketegangan dagang, arus modal keluar, hingga lonjakan dolar AS — kini berubah menjadi angin penopang. Jika The Fed mengambil langkah pelonggaran lebih agresif di 2026, seperti dugaan sejumlah pihak, penguatan yuan bisa semakin cepat.

Melemahnya dolar AS biasanya mengangkat harga Bitcoin. Alasannya cukup sederhana: saat mata uang cadangan dunia turun nilainya, aset yang dihargakan dalam dolar seperti BTC menjadi relatif lebih murah, dan narasi “emas digital” pun makin diterima.

Emas sendiri ikut menunjukkan penguatan — logam mulia ini mencatat rekor harga tertinggi bulan ini. Tapi Bitcoin masih terjebak di kisaran US$85.000–US$90.000, gagal menembus level US$90.000 dalam tiga kali percobaan pekan ini saja.

Ada beberapa faktor yang membuat respons Bitcoin terhadap kondisi ekonomi makro yang seharusnya mendukung jadi redup.

Pertama, likuiditas menjelang akhir tahun cenderung tipis. Volume perdagangan saat libur memperbesar volatilitas namun membatasi pergerakan yang didorong keyakinan kuat. Kedua, arus dana institusi berubah negatif — exchange-traded fund (ETF) Bitcoin spot AS mengalami arus keluar bersih selama lima hari berturut-turut dengan total lebih dari US$825 juta, menurut data SoSoValue.

Ketiga, kenaikan suku bunga Bank of Japan pekan lalu ke level tertinggi dalam tiga dekade membuat pasar waspada. Meskipun yen justru melemah alih-alih menguat setelah keputusan tersebut — sehingga menekan tekanan unwind carry trade — ketidakpastian langkah BOJ ke depan terus membebani minat risiko pelaku pasar.

Kondisi bullish belum mati, hanya tertunda. Beberapa analis memperkirakan dolar AS akan melemah lebih lanjut di 2026, terutama jika kebijakan pelonggaran AS melebihi ekspektasi pasar saat ini.

Jika prediksi itu terbukti, respons Bitcoin yang redup terhadap pelemahan dolar AS saat ini sepertinya lebih soal waktu, bukan karena korelasi strukturnya putus. Setelah likuiditas kembali normal pada Januari dan kebijakan The Fed menjadi lebih jelas, sinyal dari yuan mungkin baru terasa di pasar aset kripto.

Untuk saat ini, Bitcoin masih menunggu dari pinggir lapangan sementara Cina memberikan salah satu sinyal paling jelas akan pelemahan dolar AS dalam beberapa tahun belakangan.

China’s currency hits a 2.5-year high as the dollar weakens — a classic bullish setup for Bitcoin that isn’t working.

China’s onshore yuan closed at its strongest level since May 2023 on Thursday, trading at 7.0066 per dollar and nearly breaching the psychologically key 7-per-dollar mark. The move caps a 5% appreciation against the greenback since early April.

The rally is being driven by Chinese exporters rushing to convert their dollar revenues into yuan before year-end. This is more than seasonal housekeeping — analysts estimate that over $1 trillion in corporate dollars held offshore could eventually flow back to China.

Why now? The calculus has shifted. China’s economy is showing signs of recovery, the US Federal Reserve has been cutting rates, and the yuan itself is strengthening — creating a self-reinforcing cycle. Holding dollars looks less attractive when the currency you’re converting into keeps rising.

Some brokerages believe this is only the beginning. The headwinds that pressured the yuan for years — trade tensions, capital flight, a surging dollar — are now reversing into tailwinds. If the Fed eases more aggressively in 2026, as some expect, the yuan’s climb could accelerate further.

A weakening dollar typically lifts Bitcoin. The logic is straightforward: as the world’s reserve currency loses ground, dollar-denominated assets like BTC become relatively cheaper, and the “digital gold” narrative gains traction.

Gold is playing its part — the metal has hit record highs this month. Yet Bitcoin remains stuck in a $85,000-$90,000 range, unable to sustain breaks above $90,000 despite three attempts this week alone.

Several factors are muting Bitcoin’s response to what should be favorable macro conditions.

First, year-end liquidity is thin. Holiday trading volumes have amplified volatility while limiting conviction-driven moves. Second, institutional flows have turned negative — US spot Bitcoin ETFs have seen five consecutive days of net outflows totaling over $825 million, according to SoSoValue data.

Third, the Bank of Japan’s rate hike last week to a three-decade high has kept markets on edge. Although the yen weakened rather than strengthened after the decision — limiting carry trade unwind pressure — uncertainty over the BOJ’s future path continues to weigh on risk appetite.

The bullish case isn’t dead, just deferred. Some analysts expect the dollar to weaken further in 2026, particularly if US monetary easing exceeds current market expectations.

If that thesis plays out, Bitcoin’s muted response to current dollar weakness may reflect timing rather than a structural breakdown in the correlation. Once liquidity normalizes in January and Fed policy clarity improves, the yuan’s signal may finally reach crypto markets.

For now, Bitcoin watches from the sidelines as China flashes one of the clearest dollar-bearish signals in years.

The post Yuan Soars, Bitcoin Stalls: Why the Dollar Dip Isn’t Lifting Crypto appeared first on BeInCrypto.

Dibuka kembali 25 Desember 2025, Planetarium Taman Ismail Marzuki mengajak publik memahami cara kerja langit melalui teknologi proyeksi dan sains astronomi.

Dibuka kembali 25 Desember 2025, Planetarium Taman Ismail Marzuki mengajak publik memahami cara kerja langit melalui teknologi proyeksi dan sains astronomi. Harga Canton Network melonjak tajam dalam beberapa minggu terakhir, menarik perhatian pasar dengan kenaikan mingguan hampir 40%. Reli semakin kencang setelah Canton mengumumkan kolaborasi strategis bersama The Depository Trust & Clearing Corporation pada pekan lalu.

Perkembangan ini menempatkan CC di pusat diskusi institusi terkait tokenisasi, sehingga minat investor kembali meningkat.

DTCC dan Canton Network mengonfirmasi kemitraan pekan lalu untuk mendukung tokenisasi aset yang disimpan oleh The Depository Trust Company di jaringan Canton. Inisiatif ini bertujuan untuk menyediakan infrastruktur blockchain yang patuh aturan serta menjaga privasi bagi institusi keuangan yang teregulasi. Langkah ini menyoroti komitmen bersama untuk mendorong adopsi aset digital lebih luas.

Kemitraan ini mempertegas kolaborasi jangka panjang Digital Asset bersama DTCC dalam solusi blockchain berkelas institusi. Para pelaku pasar memandang pengumuman ini sebagai validasi besar untuk arsitektur Canton. Akibatnya, permintaan atas CC pun naik dengan cepat, menunjukkan kepercayaan yang terus tumbuh terhadap peran CC di pasar keuangan teregulasi.

Partisipasi investor tetap tinggi sepanjang pekan lalu sehingga reli semakin solid. Data on-chain mencatat ada 23.972 alamat aktif dalam 24 jam terakhir. Jumlah alamat ini bersama-sama melakukan lebih dari 500.000 transaksi, memperlihatkan tingkat partisipasi network yang kuat.

Sebagai pembanding, aktivitas di token besar lainnya masih lebih rendah. XRP mencatat sekitar 39.000 alamat aktif, Cardano sekitar 25.000, dan Chainlink hampir 4.000. Perbandingan ini mengindikasikan bahwa kenaikan harga CC didorong oleh penggunaan riil, bukan sekadar lonjakan spekulatif atau karena likuiditas yang tipis.

Ingin dapat insight token seperti ini? Daftar Newsletter Harian Crypto dari Editor Harsh Notariya di sini.

Indikator teknikal juga mendukung prospek bullish. Relative Strength Index (RSI) saat ini berada di atas garis nol netral, menandakan momentum positif. Posisi ini mengonfirmasi bahwa pembeli masih mendominasi, sejalan dengan kenaikan aktivitas network dan volume transaksi yang tetap tinggi.

namun, perlu tetap waspada karena RSI sudah mendekati area overbought. Kondisi seperti ini sering kali diikuti oleh koreksi jangka pendek. Selama indikator ini tidak tembus area ekstrem, tren naik CC secara keseluruhan masih terjaga secara teknikal.

Saat publikasi, harga CC diperdagangkan di kisaran US$0,106, mencerminkan kenaikan hampir 40% selama seminggu. Parabolic SAR masih menunjukkan tren naik yang aktif. Indikator ini mengisyaratkan altcoin ini mungkin memperpanjang penguatan jika situasi pasar secara umum tetap mendukung.

Breakout tegas di atas resistance US$0,109 dapat mendorong CC menuju US$0,118. Jika harga menembus level itu, jalur menuju US$0,133 akan terbuka. Pergerakan seperti ini akan memperkuat pencapaian high bulanan baru dan mempertegas struktur bullish token ini.

Risiko penurunan masih ada jika momentum mulai melemah. Kondisi overbought atau aksi ambil untung bisa menekan pergerakan harga. Jika turun di bawah US$0,101, CC bisa melanjutkan penurunan hingga ke area US$0,089 sehingga membatalkan argumen bullish saat ini.

Canton Network price has surged sharply over recent weeks, capturing market attention with a near 40% weekly gain. The rally accelerated after Canton announced a strategic collaboration with The Depository Trust & Clearing Corporation earlier last week.

This development positioned CC at the center of institutional tokenization discussions, driving renewed investor interest.

DTCC and Canton Network confirmed a partnership last week to support the tokenization of assets custodied by The Depository Trust Company on the Canton Network. The initiative aims to enable compliant, privacy-enabled blockchain infrastructure for regulated financial institutions. This move highlights a shared commitment to advancing digital asset adoption.

The partnership highlights Digital Asset’s long-standing collaboration with DTCC on institutional-grade blockchain solutions. Market participants interpreted the announcement as a major validation of Canton’s architecture. As a result, demand for CC rose quickly, reflecting growing confidence in its role within regulated financial markets.

Investor participation has remained elevated throughout the past week, supporting the sustainability of the rally. On-chain data shows 23,972 active addresses over the last 24 hours. These addresses collectively executed more than 500,000 transactions, indicating strong network engagement.

For context, comparable activity across established tokens remains lower. XRP recorded roughly 39,000 active addresses, Cardano posted about 25,000, and Chainlink logged near 4,000. This comparison suggests CC’s price increase is driven by genuine usage rather than speculative spikes or thin liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Technical indicators further support the bullish outlook. The Relative Strength Index currently sits above the neutral zero line, signaling positive momentum. This positioning confirms that buyers remain in control, aligning with the sustained rise in network activity and transaction volume.

However, caution is warranted as the RSI approaches overbought territory. Such conditions often precede short-term pullbacks. As long as the indicator avoids breaching extreme levels, CC’s broader uptrend remains technically intact.

CC price traded near $0.106 at the time of writing, reflecting a near 40% weekly increase. The Parabolic SAR continues to signal an active uptrend. This indicator suggests the altcoin may extend gains if broader market conditions remain supportive.

A decisive break above the $0.109 resistance could push CC toward $0.118. Clearing that level may open the path to $0.133. Such a move would build on the token’s recent monthly high and reinforce bullish structure.

Downside risks persist if momentum weakens. Overbought conditions or profit-taking could pressure price action. A drop below $0.101 may expose CC to a decline toward $0.089, invalidating the current bullish thesis.

The post Canton Network (CC) Has Overtaken Top Coins As Price Hit 4-Week High appeared first on BeInCrypto.

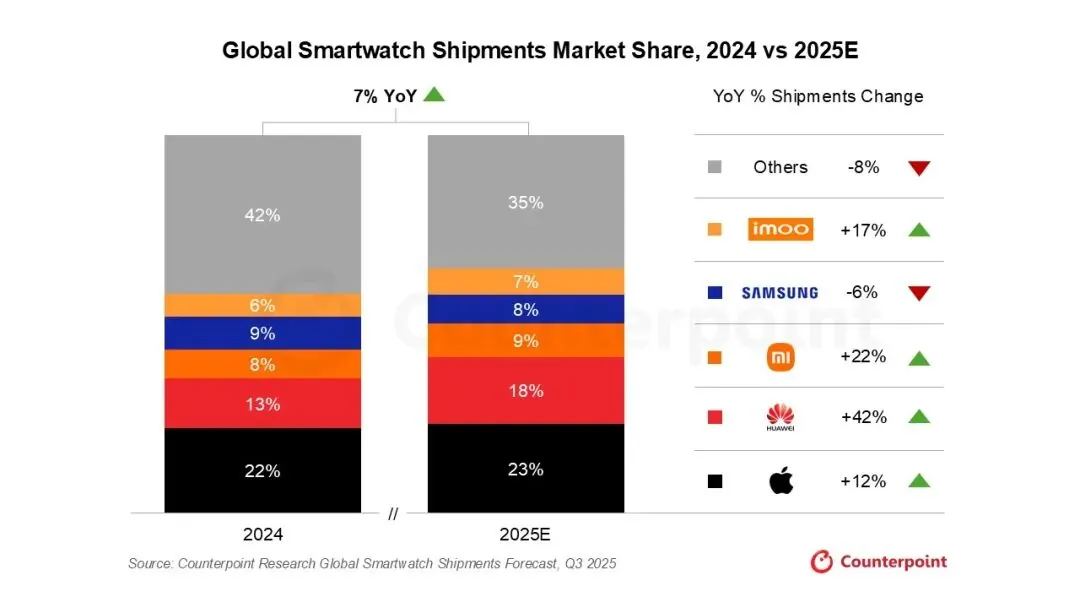

The smartwatch market worldwide is going back to growth this year, and Xiaomi is solidifying a leading position within such a recovery. According to the latest forecast from Counterpoint Research, shipments should increase steadily after the slowdown of last year. Brands will be helped by fresh hardware platforms, optimization of software, and more powerful health-focused features.

It has begun a period of recovery after the contraction in 2024. According to research by Counterpoint Research, worldwide smartwatch shipments are set to increase around 7% year over year by the end of 2025. This is mainly led by refreshed product portfolios, efficiency gains in chips, and deeper integration between hardware and software platforms.

Consumers are also showing increased interest in mid-to-high-end smartwatches. Advanced health monitoring, longer battery life, and tighter integrations with smartphones are no longer high-end exclusives but expected features.

China has now become the most important growth engine for the global smartwatch market. Analysts at Counterpoint add that three of the world’s top five smartwatch brands come from China. Government-backed consumer subsidies and climbing household incomes have accelerated the cycles of device replacements.

Xiaomi is leading this with its wide product portfolio, ranging from affordable smart bands to feature-rich smartwatches. The ecosystem approach, driven by the integration of Xiaomi HyperOS and HyperConnect, increases user retention and cross-device usage. Consequently, China’s global market share is projected to grow from 25% in 2024 to 31% in 2025.

According to data, the top five smartwatch makers in 2025 could be Apple, Huawei, Xiaomi, Samsung, and Xiaotiancai. Apple leads the list, followed by Xiaomi as it consolidates its position with steady shipment volumes and an aggressive pricing policy.

Huawei is expected to demonstrate a 42% year-on-year shipment growth, whereas Samsung may show a slight decline. Meanwhile, Xiaomi enjoys the dividends of having a balanced portfolio and a strong brand, especially in Asia and emerging markets.

Apple’s newest smartwatch generation saw shipment growth of 12% YoY in Q3 2025, breaking a long period of decline. This helps to give more stability to the overall market and indicates the renewed confidence of consumers across the category.

Consider the case of a circle which is tangent to two intersecting straight lines both internally and externally.

Honor 400 Lite adalah smartphone yang membantu pengguna dengan banyak fitur AI. Memotret street style jadi makin asyik dengan kamera 108MP.

Honor 400 Lite adalah smartphone yang membantu pengguna dengan banyak fitur AI. Memotret street style jadi makin asyik dengan kamera 108MP. Partisipasi ritel di pasar aset kripto terus menurun sepanjang siklus ini. Minat yang tercatat semakin melemah seiring berakhirnya tahun.

Sementara beberapa analis masih menafsirkan menurunnya keterlibatan ritel sebagai sinyal klasik bahwa pasar sudah di dasar atau bottom, sebagian lain berpendapat penurunan saat ini mencerminkan perubahan budaya dan sosial yang lebih dalam, di mana perhatian investor sudah beralih sepenuhnya dari kripto.

Penurunan pasar aset kripto mendorong banyak analis untuk menerawang potensi terbentuknya market bottom, dengan mengutip berbagai faktor seperti data on-chain, pola teknikal, hingga perubahan perilaku investor. Di antara semua indikator ini, jauhnya keterlibatan ritel kerap dianggap sebagai penanda terbentuknya market bottom.

Analis menyatakan bahwa masa-masa pesimisme ekstrem serta rendahnya partisipasi biasanya bertepatan dengan terbentuknya market bottom, sehingga mereka menafsirkan sikap masa bodoh yang makin meluas kini sebagai titik balik serupa.

“Ritel masuk di PUNCAK, bukan di bottom, dan absennya ritel pada momen ini menyiratkan bahwa ini bukan puncak pasar, melainkan market bottom yang sedang terbentuk,” ujar seorang analis.

Namun, data baru menunjukkan situasinya mungkin sudah berubah. Dalam sebuah unggahan baru-baru ini, analis Luc menyoroti pergeseran yang lebih dalam di kalangan ritel. Menurut dia,

“Ini bersifat kultural. Sebuah pergeseran sosial. Perhatian telah berpindah.”

Salah satu tanda nyata yaitu minat pada platform konten kripto yang merosot tajam. Misalnya, seorang YouTuber kripto dengan 139.000 subscriber melaporkan bahwa jumlah tayangannya turun jauh lebih besar dibanding titik terendah lima tahun terakhir.

Para influencer kripto terkenal juga mulai berfokus ke pasar saham tradisional. Bersama-sama, tren ini mengisyaratkan melemahnya perhatian, bukan sekadar koreksi sementara.

Di kalangan investor muda, persepsi pun berubah. Saat ini, kripto harus bersaing dengan alternatif yang lebih mudah dijangkau seperti prediction market dan saham kripto, yang memiliki risiko “rug pull” lebih rendah.

“Setiap instrumen kini semakin mudah diakses. Mulai dari COIN yang menambahkan perdagangan saham, HOOD dengan opsi 0DTE, hingga prediction market secara keseluruhan…semuanya tersedia…tanpa risiko rug-pull yang dipersepsikan dari lanskap kripto ‘tanpa hukum’ yang dulu menjadi daya tarik utama kripto,” kata Luc.

Baru-baru ini, BeInCrypto melaporkan bahwa banyak investor baru lebih memilih emas dan perak ketimbang kripto di tengah inflasi yang terus-menerus serta ketidakpastian ekonomi makro. Pergeseran ini menandai perubahan arah generasi yang lebih luas.

Citra kripto juga semakin menurun akibat banyaknya kasus peretasan dan penipuan. Menurut Chainalysis, industri kripto kehilangan lebih dari US$3,4 miliar dari Januari hingga awal Desember.

Selama periode ini, insiden keamanan meningkat, dan para penyerang memakai taktik yang makin canggih demi mencuri dana dan mengeksploitasi pengguna.

“Sekarang dianggap cringe berada di kripto. Terlalu banyak scam untuk ditangani degen rata-rata. Anak-anak lebih memilih bekerja di AI atau hal lain. Populasi umum sebenarnya tidak ingin berurusan dengan kripto, kita gagal menebus diri setelah debakel Luna + FTX + JPEG illiquid tahun 2022,” ujar Kate, pengamat pasar lainnya.

Di saat minat ritel menurun, perusahaan keuangan mapan semakin memperluas kehadirannya di kripto. Aishwary Gupta dari Polygon Labs menyampaikan ke BeInCrypto bahwa institusi saat ini menyumbang sekitar 95% aliran dana ke kripto, sedangkan partisipasi ritel turun ke sekitar 5–6%.

Dari munculnya digital asset treasury (DAT) sampai semakin banyak institusi keuangan tradisional yang masuk ke ruang ini, pasar menjadi semakin digerakkan oleh institusi. Tetap saja, dominasi institusi membawa dua sisi.

Kondisi ini menambah legitimasi serta akses yang lebih mudah, akan tetapi daya tarik awal sektor ini justru mengundang orang-orang yang ingin keluar dari keuangan tradisional. Semakin besarnya dominasi institusi bisa jadi malah menggerus hal mendasar tersebut.

“Namun dengan keterlibatan broker legacy seperti Schwab/JPMorgan dan minat pemerintah, apakah kripto sedang kehilangan demografi yang membuatnya populer sejak awal?” ujar Luc.

Luc juga menyadari bahwa banyak dinamika semacam ini sudah pernah muncul di bear market kripto sebelumnya. Tetapi, ia menekankan sekarang ada variabel baru yang “mengubah permainan”.

“Kripto nampaknya sedang berada dalam fase transisi…dari aset momentum menjadi aset infrastruktur,” tambahnya.

Jika partisipasi ritel memang menurun secara struktural, maka pertanyaan utama adalah apakah utilitas kripto di dunia nyata dapat mengimbangi menurunnya permintaan spekulatif. Adopsi blockchain untuk pembayaran, rantai pasok, dan decentralized finance semakin berkembang.

Meski begitu, masih belum jelas apakah perkembangan ini dapat memunculkan antusiasme sebesar yang mendorong siklus pasar sebelumnya. Menjelang 2026, dinamika sektor kripto mungkin bisa memberikan gambaran lebih jelas apakah ini sekadar fase sementara atau benar-benar perubahan permanen.

Bagaimana pendapat Anda tentang minimnya minat ritel yang tak lagi cerminkan market bottom kripto? Yuk, sampaikan pendapat Anda di grup Telegram kami. Jangan lupa follow akun Instagram dan Twitter BeInCrypto Indonesia, agar Anda tetap update dengan informasi terkini seputar dunia kripto!

Pergerakan harga Bitcoin tetap tidak menentu dalam beberapa sesi terakhir, mencerminkan ketidakpastian di pasar global. Pada waktu publikasi, sinyal risiko yang lebih luas sepertinya tidak memberikan arahan jelas untuk momentum jangka pendek.

Namun, ada satu sinyal menonjol yang muncul dari emas. Penguatan harga emas belakangan ini bisa membuka peluang reli baru bagi Bitcoin jika korelasi historis tetap bertahan.

Sepanjang tahun lalu, pergerakan Bitcoin semakin sering mengikuti jejak emas, memperkuat posisinya sebagai aset yang sensitif terhadap kondisi ekonomi makro. Secara historis, kenaikan tajam harga emas sering kali mendahului kenaikan harga Bitcoin. Hubungan ini terjadi karena minat risiko yang meningkat setelah arus modal berpindah dari aset defensif ke alternatif yang berisiko lebih tinggi.

Saat emas menguat, investor cenderung mencari imbal hasil yang asimetris, sehingga aliran masuk ke Bitcoin pun meningkat. Pola ini sudah berulang beberapa kali sejak awal 2024. Reli emas yang berlanjut sering kali bersamaan dengan permintaan Bitcoin yang makin tinggi, didukung partisipasi dari investor ritel dan institusi baik di pasar spot maupun derivatif.

Pengecualian terjadi pada Oktober tahun ini, saat harga Bitcoin turun tajam bersamaan dengan emas. Penurunan itu mengikuti tekanan ekonomi makro yang makin berat, termasuk kenaikan imbal hasil obligasi dan kondisi keuangan yang makin ketat. Saat ini, emas mulai mendapat momentum lagi. Jika Bitcoin tetap stabil di level saat ini, aset kripto ini bisa saja kembali diuntungkan oleh pergeseran ke mode risk-on ini.

Data on-chain menunjukkan kehati-hatian masih terasa di kalangan holder Bitcoin. Selama beberapa minggu terakhir, transfer Bitcoin ke exchange meningkat, menandakan setoran dari investor yang lebih tinggi. Angka ini biasanya mencerminkan aksi ambil untung atau persiapan mengantisipasi perlindungan dari risiko penurunan harga di masa yang tidak pasti.

Kenaikan arus masuk ke exchange tidak selalu berarti tekanan jual yang langsung terjadi. Tapi, jika tren ini terus berlanjut, biasanya diikuti volatilitas yang makin tinggi. Dalam kasus Bitcoin, peningkatan setoran ini berarti sebagian investor mengelola risiko mereka, bukan sedang mengakumulasi secara agresif. Dinamika ini sejalan dengan sentimen campuran yang saat ini membentuk pergerakan harga Bitcoin.

Harga Bitcoin diperdagangkan di US$87.773 pada waktu publikasi, berada di bawah resistance US$88.210. BTC memulai tahun 2025 di sekitar US$93.576. Saat ini, target utama tetap merebut kembali level tersebut sebelum akhir tahun, selama kondisi pasar membaik dan volatilitas tetap terjaga.

Skenario ini menjadi lebih mungkin jika Bitcoin tetap mengikuti petunjuk positif dari emas. Breakout yang terkonfirmasi mengharuskan harga Bitcoin mengubah US$88.210 menjadi level support baru. Jika bergerak bertahan di atas US$90.308, keyakinan pasar akan penguatan harga semakin tinggi dan menandakan momentum baru bagi pasar spot.

Di sisi lain, jika tekanan jual makin tinggi, skenario positif ini bisa terganggu. Jika Bitcoin kehilangan support di US$86.247, risiko penurunan akan makin besar. Penurunan ke sekitar US$84.698 bakal membatalkan asumsi bullish dan memunculkan tekanan bearish dalam waktu dekat.

Bitcoin price action has remained mixed in recent sessions, reflecting uncertainty across global markets. At the time of writing, broader risk cues offer little direction for short-term momentum.

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive asset. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems from rising risk appetite once capital rotates from defensive assets into higher-risk alternatives.

As gold strengthens, investors tend to seek asymmetric returns, benefiting Bitcoin inflows. This pattern has repeated several times since early 2024. Sustained gold rallies have coincided with higher Bitcoin demand, supported by both retail and institutional participation across spot and derivatives markets.

An exception emerged in October this year, when Bitcoin declined sharply alongside gold. That drop followed intensified macroeconomic pressure, including higher bond yields and tighter financial conditions. Currently, gold is regaining momentum. If Bitcoin maintains stability near current levels, it could once again benefit from this renewed risk-on shift.

On-chain data suggests caution remains present among Bitcoin holders. Transfers to exchanges have increased in recent weeks, signaling elevated deposits from investors. This metric often reflects profit-taking behavior or preparation for potential downside protection during uncertain market phases.

Rising exchange inflows do not always signal immediate selling pressure. However, sustained increases typically precede heightened volatility. In Bitcoin’s case, growing deposits suggest some investors are managing risk rather than aggressively accumulating. This dynamic aligns with the mixed sentiment currently shaping price action.

Bitcoin price traded at $87,773 at the time of writing, sitting below the $88,210 resistance. BTC began 2025 near $93,576. For now, the primary objective remains reclaiming that level before year-end, provided market conditions improve, and volatility remains contained.

This scenario becomes more likely if Bitcoin continues tracking gold’s bullish cues. A confirmed breakout would require flipping $88,210 into support. A sustained move above $90,308 would strengthen upside conviction and signal renewed momentum across spot markets.

Conversely, increased selling pressure could disrupt this setup. If Bitcoin loses the $86,247 support, downside risks expand. A drop toward $84,698 would invalidate the bullish thesis and reintroduce near-term bearish pressure.

The post Gold’s Rally Could Be Bitcoin’s Next Catalyst, But Risks Still Linger appeared first on BeInCrypto.

Khusus Hari Natal 2025, Epic Games Store kasih kado spesial nih. Gamer berkesempatan memiliki game PC baru secara gratis.

Khusus Hari Natal 2025, Epic Games Store kasih kado spesial nih. Gamer berkesempatan memiliki game PC baru secara gratis. Recently, the term “Deco” has been adopted more frequently at Xiaomi as a description of camera module design on their smartphones. Deco means a lot more than a camera hump on a smartphone. On the ecosystem at Xiaomi, Deco encompasses Industrial Design, Structural Design, Thermal Design, as well as Brand Identity. As smartphones get bigger and their camera modules get more complex, Deco has become a major design component that determines the aesthetics of a smartphone within the Xiaomi brand.

Deco is an in-house terminology, which is an acronym for either “Decorative Part” or “Decorative Cover”. For Xiaomi devices, it describes how it is a structural component containing camera senor, flash, or other minor elements with an added visual appeal on the back of the device.

From a design perspective, Deco has three important functions. First, it gives physical protection to the sensitive equipment of cameras, such as large image sensors and periscope lenses. Second, it gives visual order by combining various parts into a unified whole instead of using lots of separated parts in the design of cutouts. Third, it contributes to brand differentiation because the rear panel of the mobile phone has become an important section where brands showcase themselves.

Xiaomi never refers to this design feature as the “camera bump.” Instead, the word “Deco” repositions it as a Designed Feature and not a compromise.

Xiaomi’s flagship series is Deco-based and emphasizes photography and crafting. It sports a different design language for each sub-series but conveys one common message: photography is at the top of the list.

In the Ultra series of Xiaomi devices, such as the Xiaomi 14 Ultra and Xiaomi 15 Ultra, the Deco design is generally larger and round. This design directly relates to camera lens assemblies used in professional photography. The round shape is a visual indicator of optics and a testament to the camera capabilities of this line of devices.

The circular design of the Deco also enables Xiaomi to distribute a variety of sensors in a well-balanced design. The usage of metal alloys, ceramic materials, and textured surfaces increases durability and control over light reflection. This gives the camera a smooth yet not-so-glossy look.

General flagship designs, like Xiaomi 15 and Xiaomi 15 Pro, tend to sport a square or rounded-square Deco. Recent lines from Xiaomi have incorporated a trend of a smooth Deco transition into the rear panel. Additionally, this design provides better grip and fewer corners that may pose a risk or pain when held in the hand but maintains a camera zone that looks different from the rest of the phone.

POCO smartphones are sister products to Xiaomi’s offerings but are aimed at a different market altogether. Accordingly, their Deco series also have a ‘philosophy’ of their own that is centered on speed, power, and gaming identity instead of photography capabilities.

Instead of circular designs, rectangular or “Racetrack” designs of Deco layouts are utilized in POCO models. Such designs are characterized by their inspiration from machinery and autos, giving a more aggressive appearance to the phones. Contrasting patterns, texture, and larger camera frames are incorporated, making the POCO phones distinct, even when they have the same specifications as Redmi or Xiaomi smartphones.

In certain POCO cameras, the Deco is also involved in thermal management, serving as a passive heat sink plate that is then cooled by internal components. This is why POCO camera modules appear to be larger and more rugged.

Design-wise, Mi is positioned in-between Xiaomi and POCO. Mi Deco designs are relatively simpler and symmetrical. This is for ease of use and cost-effectiveness. Having cameras aligned at the center is also common, providing balance when placed on a surface.

Although it has been more holding back, Redmi Deco range may take inspiration from the high-end offerings of the brand like vegan leather or metallic finish to give a premium feel when it comes to mid-range offerings.

The current Xiaomi Deco modules are made employing advanced manufacturing technology. CNC machining, cold carving, and surface hardening are implemented to make it durable as well as consistent in terms of look. The Deco section is the most prominent area in a smartphone, so scratch resistance and strength become very important in this regard of these products by Xiaomi.

In performance-oriented models, the Deco materials may also be beneficial in Heat Dissipation, which will be very helpful in handling high workloads such as gaming or video recording.

For consumers, Deco is more than just a design feature. Deco goes on to influence the overall feel of the mobile device on a desk, how it feels when in hand, as well as how it is perceived with regards to its overall quality. A good Deco design is an indicator of the primary feature of the mobile device it holds.

Within Xiaomi mobile phones, “Deco is a strategic design architecture, not simply a camera design.” This design approach integrates protection, engineering, and visual communication into “a single module or device, known as a mega device.” Within Xiaomi smartphones, Deco is used for highlighting “imaging authority,” POCO is known for its emphasis on “power and performance” and its “mechanical designs,” while Redmi is recognized for its emphasis “on balance and functionality.”