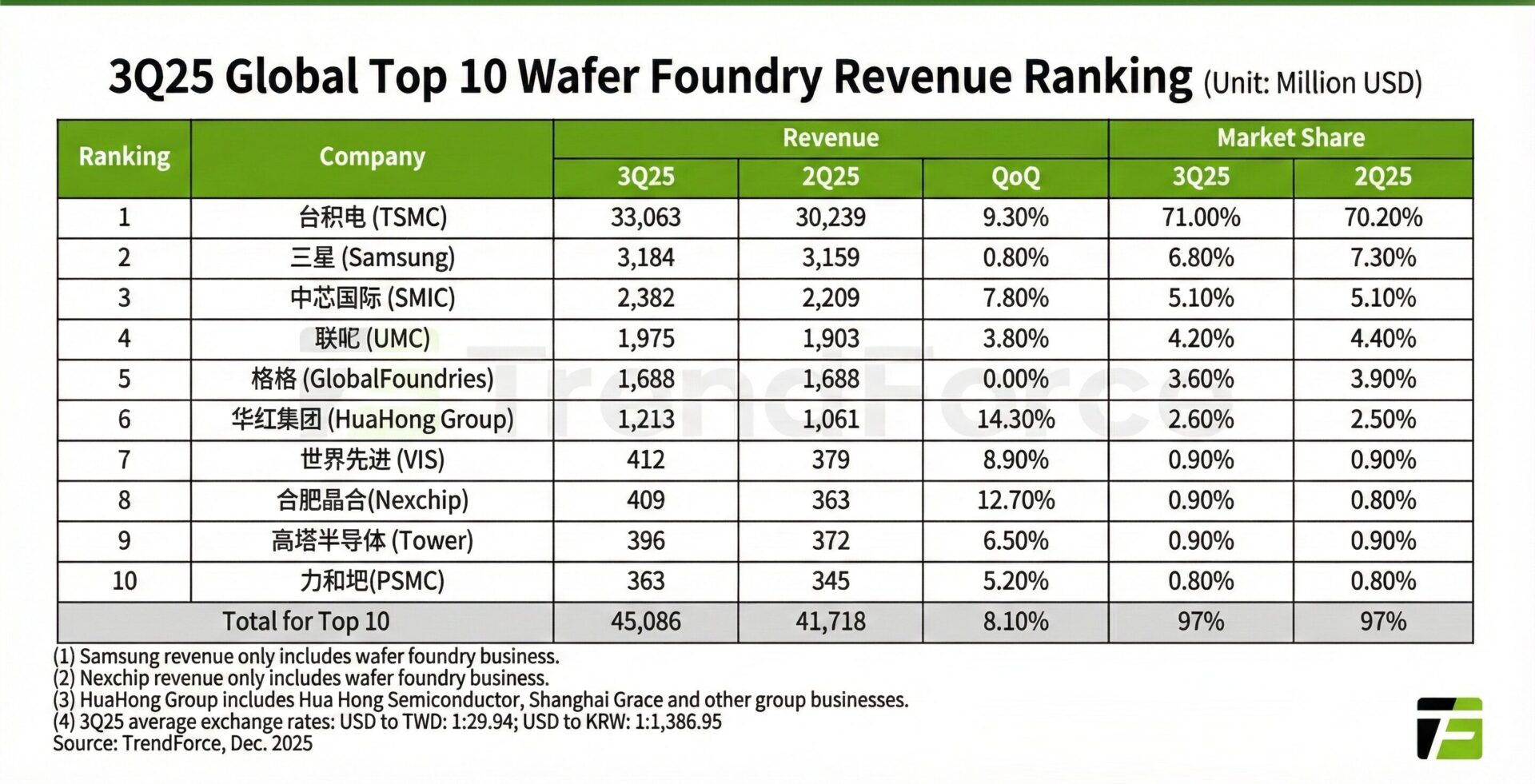

Global chip foundry revenue jumps 8.1% in Q3 2025

The latest data from TrendForce shows that the global semiconductor manufacturing industry recorded solid growth in the third quarter of 2025. Combined revenue for the world’s top ten semiconductor foundries was up 8.1% quarter-on-quarter to reach $45.09 billion. Indeed, this attests to the ongoing momentum of advanced chip manufacturing-a field Xiaomi has kept a close eye on while expanding its long-term silicon ambitions through projects like XRING O1 and its wider Xiaomi HyperOS ecosystem.

Recent chip design and supply chains have also been important in flagship platforms such as Snapdragon 8 Elite, which is behind many Xiaomi devices.

Overview of Semiconductor Foundry in Q3 2025-TrendForce

According to TrendForce’s latest report, the ranking of the global top ten wafer foundries remained stable in Q3 2025. The industry still was occupied by three major groups: TSMC, Samsung Foundry, and then a cluster including SMIC, UMC, GlobalFoundries, and Hua Hong.

One notable change within the list was Chip Integrated Circuits, which passed Tower Semiconductor in quarterly revenue and moved up the list to eighth place. That movement reflects a general uptick in the level of competition within mature and specialty process nodes, even as advanced nodes remain the primary driver of revenue.

The total revenue of $45.09 billion underlines how resilient the foundry sector has become despite ongoing geopolitical uncertainties and fluctuating component prices.

Advanced Nodes and AI Workloads Continue to Fuel Growth

Demand relating to AI HPC, flagship mobile CPUs, and supporting chips for new consumer electronics was the main growth engine in Q3 2025. TrendForce pointed out that 7nm and below advanced process technologies contributed the most to overall revenue growth during the quarter.

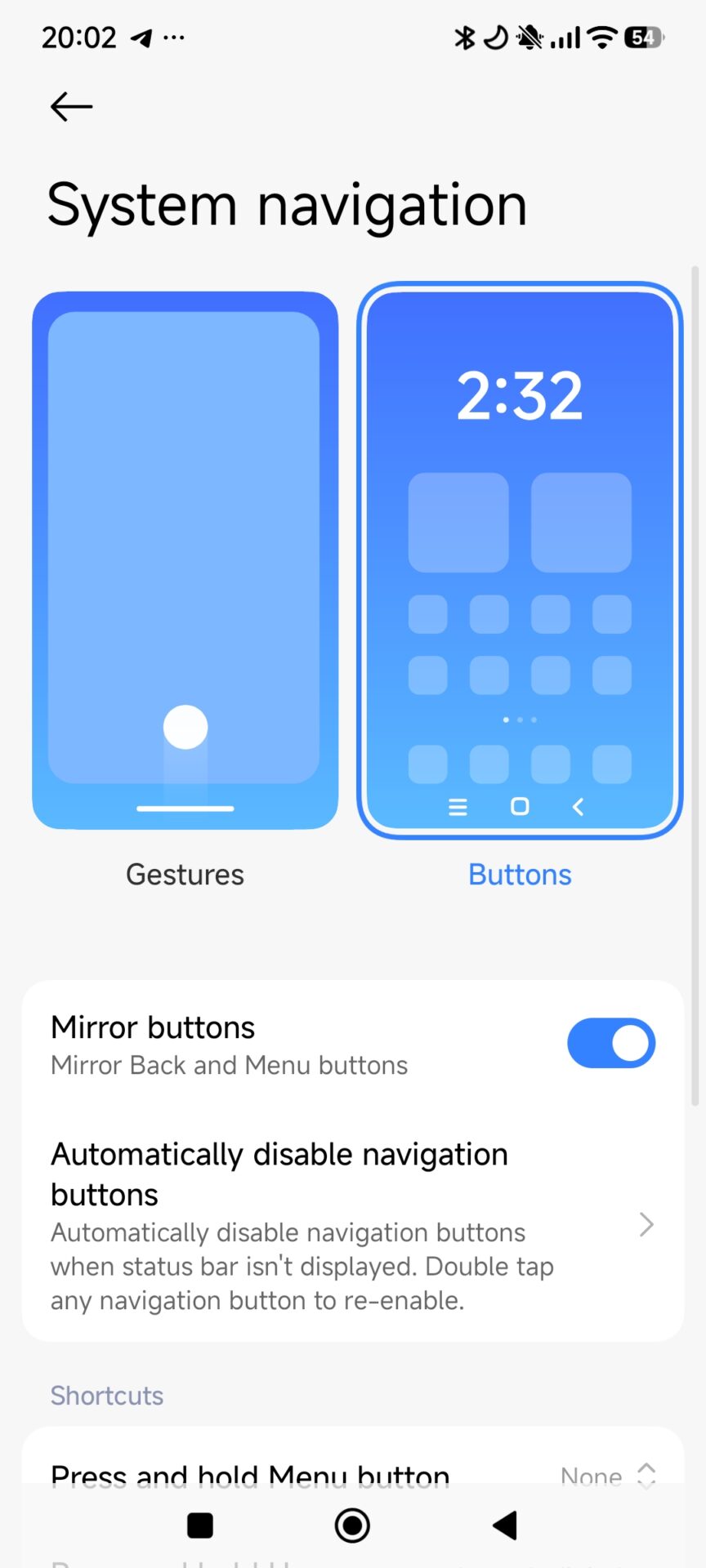

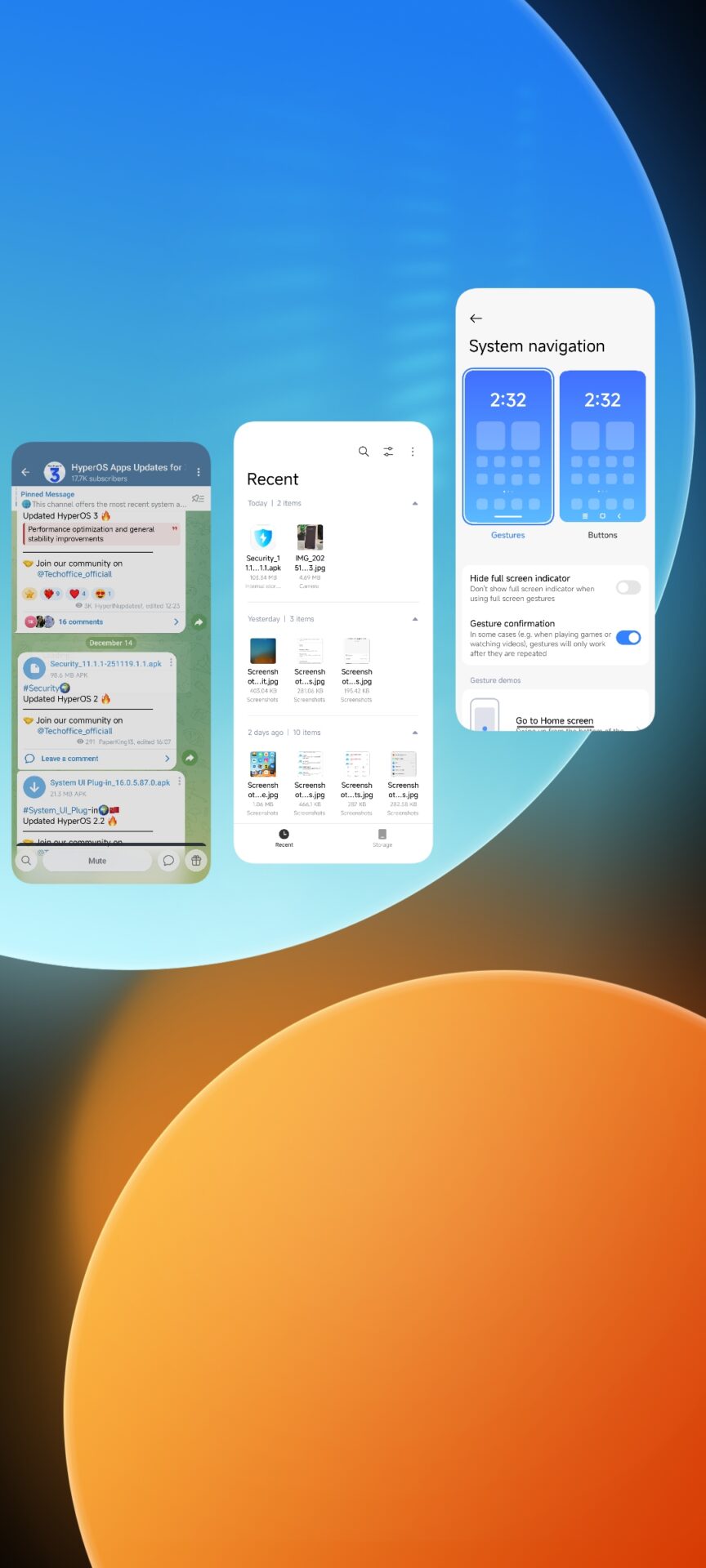

These advanced nodes are indispensable for modern smartphone SoCs, AI accelerators, and data center processors. Xiaomi’s premium smartphones, tablets, and smart devices heavily depend on such an ecosystem, particularly as the company pushes through tighter hardware–software optimization with Xiaomi HyperOS and connected services under Xiaomi HyperConnect.

Outlook for Q4 2025 and Beyond

TrendForce projects that growth momentum will be relatively more muted in Q4 2025. As memory prices rise, and the global supply chain prepares cautiously for 2026, foundries and clients are now making more conservative production plans.

Even if the automotive and industrial control sectors improve their demand, the overall capacity utilization growth is expected to remain limited. Therefore, in the last quarter of the year, year-over-year revenue growth for the top ten foundries may significantly slow down.

Can Xiaomi’s XRING Enter the Global Foundry Top 10?

Apart from that, one commonly asked question among the followers of Xiaomi is whether Xiaomi XRING would be able to enter the top ten foundries of semiconductors around the world. From a realistic industry perspective, this is **unlikely in the near term.

This places XRING in a position as a strategic internal chip initiative rather than one focused on large-scale commercial foundry services, with a focus on customized silicon, integration optimization, and long-term technological independence. The top ten is very heavily skewed towards companies with decades of experience, enormous capital expenditure, and global customer bases.

However, even without truly competing with behemoths like Apple and Samsung in the high-end SoC game, XRING can still make quite a difference for Xiaomi in performance efficiency, power management, and system-level optimization of several smartphones, Xiaomi Pad, wearables, and smart home products. This way, a long-term outlook applies to cementing Xiaomi’s ecosystem without necessarily having to engage in direct competition with established foundry behemoths.