10 Tempat yang Mirip Hasil AI tapi Asli, Ada dari Indonesia

Berbagai tempat di dunia ini sering dikira hasil AI karena kelihatan unreal! Padahal sebenarnya benar-benar ada, loh.

Berbagai tempat di dunia ini sering dikira hasil AI karena kelihatan unreal! Padahal sebenarnya benar-benar ada, loh.  Berbagai tempat di dunia ini sering dikira hasil AI karena kelihatan unreal! Padahal sebenarnya benar-benar ada, loh.

Berbagai tempat di dunia ini sering dikira hasil AI karena kelihatan unreal! Padahal sebenarnya benar-benar ada, loh.  Netizen merespons foto selfie Jennifer Lopez (JLo) dan menyebutnya telah diedit kebangetan. JLo pun memberikan klarifikasi.

Netizen merespons foto selfie Jennifer Lopez (JLo) dan menyebutnya telah diedit kebangetan. JLo pun memberikan klarifikasi.  Jepang bersiap memburu 'harta karun' bernilai tinggi dari dasar laut dalam. Mulai 2027, Negeri Sakura berencana mengolah lumpur laut kaya logam tanah jarang.

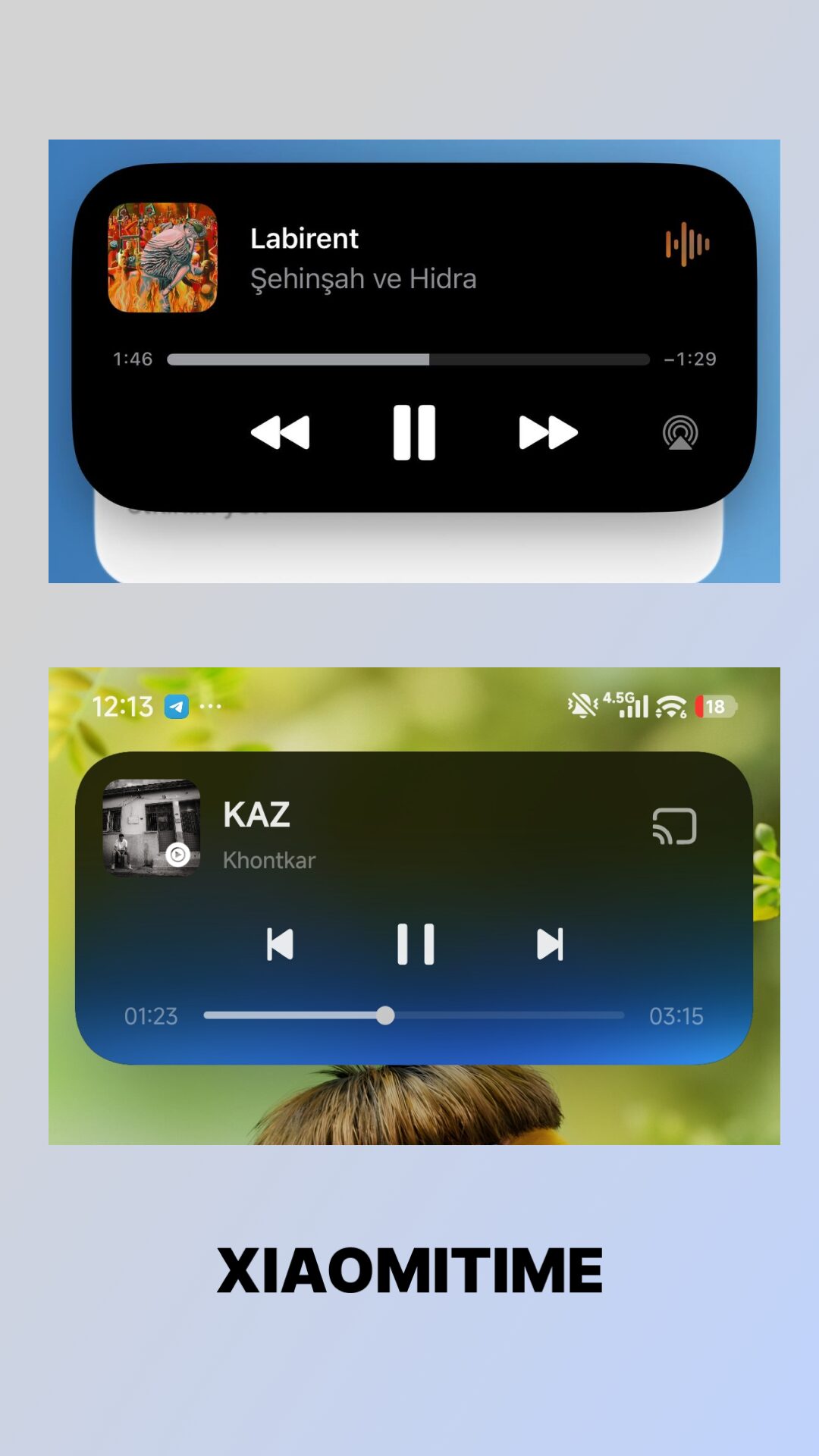

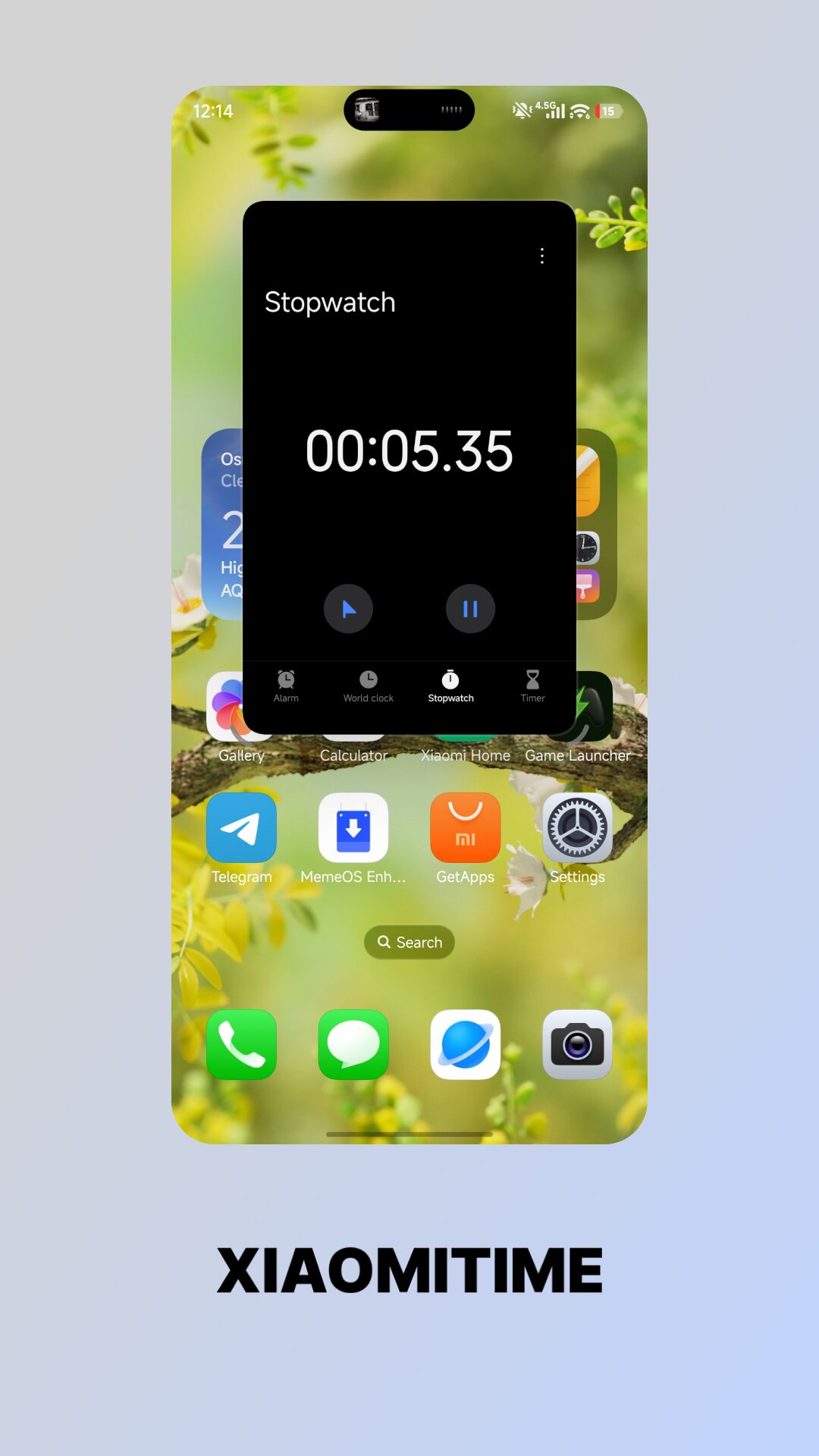

Jepang bersiap memburu 'harta karun' bernilai tinggi dari dasar laut dalam. Mulai 2027, Negeri Sakura berencana mengolah lumpur laut kaya logam tanah jarang. It’s an exciting time for Xiaomi fans as the company makes preparations for the global rollout of HyperOS 3, a historic upgrade that will change the smartphone experience forever. One of the most anticipated additions is HyperIsland, a feature that turns the front camera area into a fully interactive multitasking hub. Unlike Apple’s Dynamic Island, Xiaomi’s implementation focuses on practicality — allowing users to switch from notifications directly into multi-window or floating apps. This innovation highlights Xiaomi’s continuous effort to enhance both productivity and user experience across its devices.

HyperIsland is not about visual appeal or design flash; it’s truly a leap forward in the functionality of mobiles. Apple’s Dynamic Island, found on the likes of the iPhone 14 Pro, iPhone 15, and future iPhone 17, is itself a fashionable notification space, whereas the Xiaomi method offers the system integration more deeply.

Imagine receiving a message or notification — with just a tap, HyperIsland expands into a fully functional floating window, letting users respond instantly without disrupting their current activity. This seamless approach to multitasking is a hallmark of HyperOS 3, showcasing Xiaomi’s goal to not merely follow trends but to perfect them through innovation and engineering.

One of the standout aspects of HyperIsland is its usability. For users who constantly juggle between apps, Xiaomi’s new system design makes multitasking effortless. Whether you’re replying to messages while streaming a video or referencing notes during a meeting, everything happens in one fluid motion.

This feature exemplifies Xiaomi’s design philosophy — smooth transitions, reduced friction, and productivity at your fingertips.

The global release of HyperOS 3 will begin in October, and HyperIsland will be accessible for millions of people across the world. But for the time being, this feature will be available only on mid-range and flagships to ensure the best experience. A few low-end phones and some Xiaomi Pad series models may be excluded at least for now, since Xiaomi focuses on delivering the best experience on high-end hardware.

If you’re eagerly awaiting the update, get your device ready. Buyers can download the MemeOS Enhancer app from the Play Store to manually update system apps, unlock hidden capabilities, and prepare for the forthcoming HyperOS 3 launch. The tool keeps you on top of every single improvement Xiaomi releases, delivering a smoother and faster upgrade process.

PorteuX 2.5 Linux distribution is now available for download with Linux kernel 6.17, GNOME 49.1, KDE Plasma 6.5.2, LXQt 2.3, and more. Here’s what else is new!

The post PorteuX 2.5 Is Out with Flatpak Support, Cinnamon 6.6, COSMIC 1.0, and Linux 6.18 appeared first on 9to5Linux - do not reproduce this article without permission. This RSS feed is intended for readers, not scrapers.

Vitalik Buterin memperingatkan bahwa pendekatan regulasi Uni Eropa di bawah Digital Services Act berisiko melemahkan pluralisme dengan mencoba tidak memberi “ruang” bagi ucapan atau produk yang kontroversial di internet.

Dalam sebuah unggahan panjang di X, co-founder Ethereum ini berpendapat bahwa masyarakat bebas tidak seharusnya berupaya menghilangkan ide-ide yang dianggap berbahaya. Ia menuturkan, sebaiknya regulator fokus mencegah agar konten semacam itu tidak diperkuat secara algoritmik dan mendominasi perbincangan publik.

Digital Services Act berlaku untuk seluruh ekosistem online. Setiap layanan yang menjangkau pengguna Uni Eropa termasuk dalam undang-undang ini, terlepas dari ukuran atau lokasinya. Kewajiban mengikuti skala jangkauan dan risiko, tapi tidak ada platform yang ada di luar regulasi ini.

Desain peraturan ini bertujuan menutup celah hukum dan teknis yang sebelumnya memungkinkan platform menghindari tanggung jawab.

Para pengkritik menyebutnya sebagai pendekatan “tanpa ruang”, artinya tidak ada celah digital tanpa regulasi di mana konten berbahaya bisa lolos tanpa pertanggungjawaban.

This is what I worry Europe will get negatively polarized into: an ideology taking pride in a neat, sanitized online environment free of evil corporate and fascist pathogens.

— vitalik.eth (@VitalikButerin) December 26, 2025

I hope European govs do not go this way, and instead take a Pirate Party approach of user empowerment.… https://t.co/oH7Yfdg9pa

Tujuannya bukan penyensoran total. Melainkan, DSA fokus pada penilaian risiko, transparansi, dan pilihan desain platform yang memengaruhi bagaimana konten menyebar.

Buterin menyebut bahwa kegagalan nyata dari media sosial saat ini bukan karena ada pandangan ekstrem, namun karena algoritma sering mendorong penyebaran opini-opini tersebut secara luas.

Ia memperingatkan bahwa pemikiran tanpa toleransi bisa menyebabkan tindakan berlebihan, konflik, dan makin besarnya ketergantungan pada penegakan secara teknokratis.

should be solved at as local a level as possible, ideally the operator of whatever institution is using the room and organizing toddlers to come there, otherwise the municipality

— vitalik.eth (@VitalikButerin) December 26, 2025

Buterin juga memperingatkan bahwa memperlakukan ide-ide yang tidak disukai seperti patogen yang harus dihapus mencerminkan naluri anti-pluralisme. Ia menyampaikan bahwa perdebatan merupakan bagian tak terhindarkan dalam masyarakat terbuka dan upaya menghapus pandangan kontroversial secara total justru akan memperluas pengawasan serta kewenangan penegakan hukum.

Ia mendorong pemberdayaan pengguna, transparansi, serta persaingan sehat. Menurutnya, platform seharusnya mengurangi insentif yang membuat konten berbahaya menjadi menarik, bukan memaksa menghapusnya sepenuhnya.

Perdebatan ini juga menyoroti privacy coin seperti Monero dan Zcash.

Saat regulator mendorong platform untuk memantau perilaku dan mengumpulkan lebih banyak data, makin banyak pengguna yang sadar bahwa pengawasan lebih besar sering berujung pada terbukanya lebih banyak data mereka.

Hal ini memperkuat narasi untuk alat keuangan yang dirancang meminimalkan jejak transaksi.

Meskipun begitu, dampaknya tidak merata. Meskipun dukungan filosofis pada privacy coin bisa bertambah, akses di pasar Uni Eropa yang teregulasi tetap terbatas. Exchange terus membatasi atau menghapus privacy coin ini karena risiko kepatuhan.

Singkatnya, pendekatan Eropa semakin menegaskan pentingnya privasi, meski membuat alat berfokus privasi menjadi semakin terbatas ruang geraknya.

Vitalik Buterin has warned that the European Union’s regulatory approach under the Digital Services Act risks undermining pluralism by trying to leave “no space” for controversial speech or products online.

In a detailed post on X, the Ethereum co-founder argued that a free society should not aim to eliminate ideas it considers harmful. Instead, he said regulators should focus on stopping such content from being algorithmically amplified and dominating public discourse.

The Digital Services Act applies to the entire online ecosystem. Any service reaching EU users falls under the law, regardless of size or location. Obligations scale with reach and risk, but no platform sits outside the regulatory framework.

This design aims to close legal and technical loopholes that previously allowed platforms to avoid responsibility.

Critics describe this as a “no-space” approach, meaning there should be no unregulated digital gaps where harmful content can escape accountability.

This is what I worry Europe will get negatively polarized into: an ideology taking pride in a neat, sanitized online environment free of evil corporate and fascist pathogens.

— vitalik.eth (@VitalikButerin) December 26, 2025

I hope European govs do not go this way, and instead take a Pirate Party approach of user empowerment.… https://t.co/oH7Yfdg9pa

The goal is not blanket censorship. Instead, the DSA focuses on risk assessments, transparency, and platform design choices that influence how content spreads.

Buterin said the real failure of modern social platforms is not that fringe views exist, but that algorithms often push them at scale.

He warned that zero-tolerance thinking can lead to overreach, conflict, and growing reliance on technocratic enforcement.

should be solved at as local a level as possible, ideally the operator of whatever institution is using the room and organizing toddlers to come there, otherwise the municipality

— vitalik.eth (@VitalikButerin) December 26, 2025

Buterin warned that treating disliked ideas as pathogens to be erased reflects an anti-pluralistic instinct. He argued that disagreement is inevitable in open societies and that trying to fully remove controversial views often expands surveillance and enforcement powers.

He advocated for user empowerment, transparency, and competition. In his view, platforms should reduce incentives that reward harmful content, rather than attempting to eliminate it entirely.

The debate has also drawn attention to privacy coins such as Monero and Zcash.

As regulators push platforms to monitor behavior and retain more data, users may grow more aware that increased oversight often leads to greater data exposure.

That strengthens the narrative appeal of financial tools designed to minimize traceability.

However, the impact is uneven. While philosophical support for privacy coins may grow, access in regulated EU markets remains constrained. Exchanges continue to limit or delist them due to compliance risk.

In short, Europe’s approach reinforces why privacy matters, even as it complicates where privacy-focused tools can operate.

The post Vitalik Buterin Slams EU’s ‘No-Space’ Digital Rules appeared first on BeInCrypto.

Pasar aset kripto akan memasuki akhir pekan terakhir tahun 2025, dan sebelum tahun baru dimulai, masih ada peluang bagi altcoin untuk tumbuh.

Dipimpin oleh Pippin (PIPPIN), tiga altcoin ini wajib dipantau dalam 48 jam ke depan saat kita mendekati pergantian tahun.

Harga LEO naik 25% dalam sepekan terakhir, dan diperdagangkan di sekitar US$8,45 pada waktu publikasi. Struktur teknikal menunjukkan support yang kuat, dengan Parabolic SAR menandakan tren naik yang masih aktif. Sinyal ini memperlihatkan bahwa pembeli masih memegang kendali seiring dengan meningkatnya momentum, walaupun ada ketidakpastian di pasar secara umum.

Jika kondisi bullish tetap bertahan, LEO bisa rebound ke US$9,10, dan menutup kerugian yang sempat tercatat di awal bulan ini. Tekanan beli yang konsisten bisa memperpanjang kenaikan menuju target US$9,80. Mencapai level ini akan mencerminkan kepercayaan baru dan memperkuat tren naik yang terjadi dalam jangka pendek.

Ingin dapat insight token seperti ini? Daftar ke Newsletter Harian Crypto dari Editor Harsh Notariya di sini.

Risiko koreksi tetap ada jika investor memutuskan untuk ambil untung lebih awal. Tekanan jual bisa mendorong LEO turun di bawah support US$7,82. Jika penurunan berlanjut sampai US$7,32, struktur teknis akan menjadi lemah, skenario bullish tidak berlaku lagi, dan ini bisa menjadi sinyal perubahan momentum ke arah bearish dalam jangka pendek.

PIPPIN muncul menjadi salah satu altcoin top gainer minggu ini, dengan kenaikan sebesar 34% dalam tujuh hari terakhir. Token ini terus mencetak all-time high baru setiap minggu. Minat beli yang tinggi dan momentum yang kuat mendorong kenaikan terus-menerus pada PIPPIN.

All-time high terbaru berada di US$0,720, di mana PIPPIN membutuhkan kenaikan 45,6% lagi untuk mencapainya kembali. Untuk mencapainya, PIPPIN harus bisa menjadikan US$0,600 sebagai support kuat. Jika level ini bisa dipertahankan, maka kekuatan pembeli akan terbukti dan kemungkinan harga akan terus naik pun semakin besar.

Risiko koreksi tetap mengancam jika sentimen pasar secara umum berubah menjadi bearish. Minat terhadap risiko yang melemah bisa menyeret PIPPIN turun di bawah support US$0,434. Jika breakdown terjadi, kerugian bisa terus berlanjut ke area US$0,366, menghapus kenaikan terbaru dan membatalkan outlook bullish yang sedang berjalan.

Harga MYX diperdagangkan di sekitar US$3,35 pada waktu publikasi setelah naik 15,2% dalam tujuh hari terakhir. Altcoin ini masih bertahan di atas support US$3,26. Struktur saat ini menandakan bahwa pembeli menargetkan resistance di US$3,62 seiring momentum yang perlahan terbentuk.

Indikator teknikal menguatkan bias bullish. Relative Strength Index tetap di atas level netral 50,0, menandakan tekanan beli yang berkelanjutan. Kekuatan ini dapat mendukung reli lanjutan. Breakout yang terkonfirmasi di atas US$3,62 bisa membuka jalan menuju US$3,80 dalam waktu dekat.

Risiko koreksi tetap ada jika kondisi pasar secara umum memburuk. Tekanan jual yang meningkat bisa menekan MYX turun di bawah support US$3,26. Jika breakdown terjadi, harga bisa menuju US$2,88, membatalkan outlook bullish dan menandai perubahan momentum ke arah bearish dalam jangka pendek.

The crypto market is heading into the final weekend of 2025, and before the new year begins, there might be some room for altcoins to record growth still.

Led by Pippin (PIPPIN), these three altcoins are must-watch in the coming 48 hours as we near the year-end.

LEO price surged 25% over the past week, trading near $8.45 at the time of writing. The technical structure shows strong support, with the Parabolic SAR confirming an active uptrend. This setup suggests buyers remain in control as momentum builds despite broader market uncertainty.

If bullish conditions persist, LEO could rebound toward $9.10, recovering losses recorded earlier this month. Sustained buying pressure may extend gains toward the $9.80 target. Achieving this level would reflect renewed confidence and reinforce the prevailing upward trend in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risks remain if investors move to lock in profits early. Selling pressure could push LEO below the $7.82 support. A further decline toward $7.32 would weaken technical structure, invalidate the bullish thesis, and signal a potential shift back to short-term bearish momentum.

PIPPIN has emerged as one of the strongest-performing altcoins this week, gaining 34% over the past seven days. The token continues to post fresh all-time highs on a weekly basis. Persistent buying interest and strong momentum have supported its sustained upward trajectory.

The latest all-time high stands at $0.720, with PIPPIN requiring a 45.6% move to revisit that level. Achieving this depends on flipping $0.600 into firm support. A successful hold above that zone would confirm strength and increase the probability of continued price discovery.

Downside risk remains if broader market sentiment turns bearish. Weakening risk appetite could push PIPPIN below the $0.434 support. A breakdown there may extend losses toward $0.366, erasing recent gains and invalidating the prevailing bullish outlook.

MYX price traded near $3.35 at the time of writing after rising 15.2% over the past seven days. The altcoin continues to hold above the $3.26 support. The current structure suggests buyers are targeting the $3.62 resistance as momentum gradually builds.

Technical indicators reinforce the bullish bias. The Relative Strength Index remains above the neutral 50.0 level, signaling sustained buying pressure. This strength could support further recovery. A confirmed breakout above $3.62 may open the path toward $3.80 in the short term.

Downside risks persist if broader market conditions weaken. Increased selling pressure could push MYX below the $3.26 support. A breakdown there would expose the $2.88 level, invalidating the bullish outlook and signaling a shift back toward short-term bearish momentum.

The post 3 Altcoins To Watch This Weekend | December 27 – 28 appeared first on BeInCrypto.

Dampak dari insiden ekstensi Chrome Trust Wallet makin memanas pada 26 Desember, setelah Changpeng Zhao (CZ) angkat bicara di depan umum dan mengindikasikan bahwa pelanggaran ini sepertinya melibatkan orang dalam.

Pernyataan ini muncul bersamaan dengan konfirmasi dari Trust Wallet bahwa sekitar US$7 juta dana pengguna telah terdampak sejauh ini.

CZ menuturkan Trust Wallet akan mengganti penuh seluruh dana pengguna yang terdampak dan menegaskan bahwa dana pelanggan tetap aman.

Ia juga menambahkan bahwa tim investigasi masih menelusuri bagaimana pembaruan ekstensi browser yang sudah terinfeksi bisa lolos dari pengawasan distribusi, dan menyebut peran orang dalam sebagai penyebab yang “paling mungkin.”

Pernyataan ini pun semakin menyoroti kekhawatiran soal akses internal dan tata kelola update, tidak hanya soal serangan eksternal semata.

Most likely.

— CZ 🔶 BNB (@cz_binance) December 26, 2025

Trust Wallet kemudian mengonfirmasi bahwa insiden ini hanya mempengaruhi Browser Extension versi 2.68 saja, dan menegaskan lagi bahwa pengguna mobile serta versi lain tetap aman.

Pihak perusahaan mengungkapkan bahwa mereka sedang merampungkan prosedur penggantian dana dan akan memberikan instruksi yang jelas untuk pengguna yang terdampak.

Di sisi lain, pengguna harus tetap waspada dari upaya phishing yang menyamar sebagai layanan resmi.

Update on the Trust Wallet Browser Extension (v2.68) incident:

— Trust Wallet (@TrustWallet) December 26, 2025

We’ve confirmed that approximately $7M has been impacted and we will ensure all affected users are refunded.

Supporting affected users is our top priority, and we are actively finalizing the process to refund the… https://t.co/2XRx8GvZ75

Isu orang dalam ini menarik perhatian khusus di komunitas keamanan aset kripto. Karena, ekstensi browser butuh kunci penandatanganan, kredensial pengembang, serta alur persetujuan untuk bisa melakukan update.

Agar sebuah build berbahaya atau yang sudah terinfeksi dapat didistribusikan lewat Chrome Web Store resmi, penyidik biasanya mencari apakah ada kompromi kredensial atau akses internal secara langsung.

Kedua skenario itu mengarah ke lemahnya keamanan operasional, bukan pada celah software yang umum.

Risiko seperti ini memang nyata. Sepanjang tahun lalu, beberapa insiden ekstensi browser berprofil tinggi juga terjadi akibat akun pengembang yang dibajak atau pipeline rilis yang disusupi.

Reaksi pasar pun mencerminkan ketidakpastian ini. Native token Trust Wallet, TWT, langsung terjual besar-besaran setelah laporan awal pada 25 Desember.

namun, harga TWT kembali stabil dan menguat pada 26 Desember, usai ada kepastian bahwa kerugian terbatas dan ada proses penggantian dana untuk pengguna.

Meskipun Trust Wallet bergerak cepat dalam menangani insiden ini, kejadian ini mencerminkan tantangan yang lebih besar di industri.

Sebab, seiring makin banyak wallet aset kripto yang bergantung pada ekstensi browser, keamanan update dan pengelolaan risiko orang dalam jadi area serangan yang sangat krusial—bukan sekadar prioritas kedua.

The fallout from Trust Wallet’s Chrome extension incident intensified on December 26 after Changpeng Zhao (CZ), weighed in publicly, suggesting the breach may have involved an insider.

The comment came as Trust Wallet confirmed that roughly $7 million in user funds have been affected so far.

CZ said Trust Wallet will fully reimburse impacted users and stressed that customer funds remain safe.

However, he added that investigators are still examining how a compromised browser extension update was able to pass through distribution controls, calling an insider role “most likely.”

The statement amplified concerns around internal access and update governance, rather than an external exploit alone.

Most likely.

— CZ 🔶 BNB (@cz_binance) December 26, 2025

Trust Wallet later confirmed that the incident affected Browser Extension version 2.68 only, reiterating that mobile users and other versions were not impacted.

The company said it is finalizing reimbursement procedures and will issue clear instructions to affected users.

Meanwhile, users should remain cautious against phishing attempts posing as official support.

Update on the Trust Wallet Browser Extension (v2.68) incident:

— Trust Wallet (@TrustWallet) December 26, 2025

We’ve confirmed that approximately $7M has been impacted and we will ensure all affected users are refunded.

Supporting affected users is our top priority, and we are actively finalizing the process to refund the… https://t.co/2XRx8GvZ75

The insider angle has drawn particular attention within the crypto security community. Browser extensions require signing keys, developer credentials, and approval workflows to publish updates.

For a malicious or compromised build to be distributed through the official Chrome Web Store, investigators typically look at either credential compromise or direct internal access.

Both scenarios point to weaknesses in operational security rather than a traditional software vulnerability.

Such risks are not theoretical. Over the past year, several high-profile browser extension incidents have stemmed from hijacked developer accounts or compromised release pipelines.

Market reaction reflected the uncertainty. Trust Wallet’s native token, TWT, saw a sharp sell-off following the initial reports on December 25.

However, prices stabilized and rebounded on December 26 after confirmation that losses were limited and refunds would be issued.

While Trust Wallet has moved quickly to contain the incident, the episode reflects a broader industry challenge.

As crypto wallets increasingly rely on browser extensions, update security and insider risk management are emerging as critical attack surfaces, not secondary concerns.

The post Trust Wallet Incident Deepens as CZ Suggests Possible Insider Role appeared first on BeInCrypto.

Inkscape 1.4.3 open-source SVG (Scalable Vector Graphics) editor is now available for download with new features and enhancements. Here’s what’s new!

The post Inkscape 1.4.3 Open-Source SVG Editor Improves PDF Import and Text on Path appeared first on 9to5Linux - do not reproduce this article without permission. This RSS feed is intended for readers, not scrapers.

Saat satu tahun lagi berakhir, harapan akan tahun depan yang bullish nampaknya semakin berkembang di antara para investor. Walaupun biasanya Bitcoin yang memimpin altcoin untuk naik, beberapa token sudah membuktikan jalannya sendiri karena faktor-faktor tertentu.

BeInCrypto sudah menganalisis tiga altcoin yang bisa mengalami pertumbuhan dan bahkan membentuk all-time high baru pada Januari 2026.

Harga Monero masih berada di kisaran yang dekat dengan all-time high miliknya, hanya turun 17,5% dari US$519. Jika bisa breakout di atas level tersebut, Monero bakal mencetak rekor baru. Relative strength menunjukkan permintaan yang konsisten karena XMR masih mengungguli banyak aset kripto berkapitalisasi besar di tengah siklus pasar saat ini.

Monero mendapatkan keuntungan dari meningkatnya perhatian pada aset kripto yang fokus pada privasi. Narasi ini semakin kuat di tengah perdebatan regulasi dan permintaan pengguna untuk kerahasiaan keuangan. Chaikin Money Flow memperlihatkan arus modal yang kuat. Faktor-faktor ini dapat mendorong XMR menembus US$450 dan menuju level psikologis US$500, sebagai langkah penting untuk mencapai US$519.

Ingin insight token seperti ini? Daftar ke Crypto Newsletter Harian dari Editor Harsh Notariya di sini.

Risiko penurunan tetap ada jika pengambilan profit jadi lebih masif sebelum breakout terjadi. Tekanan jual bisa menekan XMR di bawah zona support US$417. Kalau breakdown ini terkonfirmasi, penurunan bisa lanjut ke US$387, menghapus kenaikan terbaru dan membatalkan prospek bullish untuk jangka pendek.

NIGHT menarik minat besar dari investor karena foundation dan kepemimpinannya. Token ini dikembangkan oleh Charles Hoskinson, founder Cardano, sehingga proyek NIGHT punya kredibilitas dan visi jangka panjang. Asosiasi ini memperkuat kepercayaan pasar dan menempatkan NIGHT untuk potensi apresiasi harga seiring adopsi yang meningkat di awal fase perdagangan.

Sebagai token yang baru meluncur, NIGHT diperkirakan akan mengalami pertumbuhan pengguna dan permintaan yang stabil. Jika mampu rebound dari support US$0,075, harganya bisa naik ke US$0,100. Breakout di atas level tersebut mungkin membawa NIGHT ke US$0,120, atau naik 54,1% dan mencatat all-time high baru.

Risiko penurunan sangat bergantung pada kondisi pasar secara luas di awal tahun. Jika 2025 dibuka dengan positif, momentum dapat terjaga. namun, ketika sentimen malah memburuk, NIGHT dapat turun di bawah US$0,075. Penurunan menuju US$0,060 akan membatalkan prospek bullish dan menandakan tekanan jual semakin tinggi.

Ethereum masih sekitar 66,7% di bawah all-time high US$4.956, menegaskan betapa masih panjang tahap pemulihan yang dibutuhkan. Reli super cepat seperti keajaiban sepertinya belum mungkin terjadi di situasi saat ini. Gerakan harga terbaru menunjukkan ETH masih butuh permintaan yang kuat dan keselarasan pasar secara umum untuk bisa bergerak naik signifikan.

Pada bulan Agustus, Ethereum sempat melesat untuk mencetak rekor baru, tapi mengulangi pergerakan itu dalam waktu dekat kelihatannya tidak mungkin. Setiap pemulihan mungkin butuh waktu beberapa minggu dan didukung oleh investor secara konsisten. Breakout meyakinkan di atas level psikologis US$3.000 sangat penting. Jika berhasil, ETH bisa terdorong ke US$3.287, memperkecil jaraknya dengan rekor tertinggi.

Selain itu, korelasi kuat antara Ethereum dan Bitcoin juga akan jadi faktor utama. Kalau BTC bisa menunjukkan momentum bullish, ETH berpeluang ikut naik.

namun, risiko tetap ada jika momentum bullish gagal berkembang dan BTC justru turun di chart. Ethereum dapat tetap terjebak konsolidasi dekat US$3.000 atau terkoreksi ringan. Lemahnya harga dalam waktu lama di level ini akan memperlambat upaya pemulihan. Pergerakan seperti itu akan membatalkan skenario bullish serta menunda jalur realistis untuk bergerak ke zona resistance yang lebih tinggi.

As another year comes to an end, the hope of a bullish next year is likely proliferating among the investors. While the leash generally sits with Bitcoin to lead the altcoins upwards, some tokens have carved out their path owing to independent factors.

BeInCrypto has analysed three such altcoins that could witness growth and also form new all-time highs in January 2026.

Monero price remains among the closest to its all-time high, trading just 17.5% below $519. A breakout above this level would establish a new record. Relative strength reflects sustained demand as XMR continues to outperform many large-cap cryptocurrencies during the current market cycle.

Monero benefits from growing attention toward privacy-focused cryptocurrencies. This narrative has strengthened amid regulatory debates and user demand for financial confidentiality. Chaikin Money Flow indicates strong capital inflows. These factors could drive XMR above $450 and toward the $500 psychological level, a key step toward $519.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if profit-taking intensifies before a breakout occurs. Selling pressure could push XMR below the $417 support zone. A confirmed breakdown may extend losses toward $387, erasing recent gains and invalidating the bullish outlook in the short term.

NIGHT has attracted strong investor interest due to its foundation and leadership. Developed by Cardano founder Charles Hoskinson, the project benefits from credibility and long-term vision. This association has strengthened market confidence, positioning NIGHT for potential price appreciation as adoption builds in early trading phases.

As a newly launched token, NIGHT is expected to see steady growth in users and demand. A successful bounce from the $0.075 support could lift the price toward $0.100. A breakout above that level may drive NIGHT to $0.120, marking a 54.1% gain and a potential new all-time high.

Downside risk depends heavily on broader market conditions at the start of the year. A positive 2025 open could sustain momentum. However, deteriorating sentiment may push NIGHT below $0.075. A drop toward $0.060 would invalidate the bullish outlook and signal increased selling pressure.

Ethereum remains roughly 66.7% below its $4,956 all-time high, highlighting the scale of recovery still required. A rapid, miracle-style rally appears unlikely under current conditions. Recent price action suggests ETH needs sustained demand and broader market alignment before attempting a meaningful upside move.

In August, Ethereum briefly surged to set a new peak, but replicating that move soon appears improbable. Any recovery may take weeks and requires consistent investor support. A decisive break above the $3,000 psychological level is critical. Success there could lift ETH toward $3,287, narrowing the gap to its record high.

Furthermore, the strong correlation that Ethereum shares with Bitcoin will be a major factor. If BTC manages to post a bullish momentum, ETH can benefit from it and rise as well.

However, risk remains if bullish momentum fails to develop and BTC ends up falling on the charts. Ethereum could continue consolidating near $3,000 or face a mild correction. Prolonged weakness at this level would undermine recovery efforts. Such price action would invalidate the bullish thesis and delay any realistic path toward higher resistance zones.

The post 3 Altcoins That Could Hit New All-Time Highs In January 2026 appeared first on BeInCrypto.

Apple disebut akan makin bergantung pada perusahaan asal Korea Selatan tersebut untuk pasokan memori, di tengah lonjakan harga DRAM global.

Apple disebut akan makin bergantung pada perusahaan asal Korea Selatan tersebut untuk pasokan memori, di tengah lonjakan harga DRAM global. Selamat datang di US Crypto News Morning Briefing—ringkasan utama untuk perkembangan terpenting di dunia aset kripto hari ini.

Siapkan kopi dan pantau dengan saksama: ketika emas melonjak ke level tertinggi baru, dan menandakan rotasi modal ke arah instrumen aman, Bitcoin masih tertahan di bawah US$90.000. Struktur opsi senilai US$300 juta menahan volatilitas, tapi setelah kadaluarsa besar-besaran ini, kondisi tenang tersebut bisa langsung berubah menjadi pergerakan harga yang dramatis.

Emas melonjak ke level tertinggi baru, menembus batas atas multi-tahun dan semakin mengukuhkan reputasinya sebagai sinyal peringatan awal pasar saat modal mulai bergerak ke aset aman.

Namun, Bitcoin tidak merespons dengan cara yang sama. Sebaliknya, aset kripto terbesar di dunia ini masih tertahan di bawah US$90.000.

Informasi terbaru mengindikasikan hal ini bukan karena menurunnya permintaan, melainkan imbas dari struktur derivatif raksasa yang secara mekanis menahan pergerakan harga.

“Gold made the first move. Bitcoin is still loading,” ujar analis Crypto Tice.

Analis tersebut memaparkan bahwa breakout emas sering menjadi penanda awal likuiditas mulai bergeser, sementara Bitcoin biasanya bereaksi belakangan, setelah minat risiko kembali muncul.

“Gold tends to move first when liquidity seeks safety. Bitcoin follows when risk appetite turns back on,” tutur CryptoTice, seraya menambahkan bahwa fase kompresi seperti itu “tidak memudar secara perlahan,” melainkan berujung pada ekspansi yang dapat mengulang seluruh siklus pasar.

Analisis dari BeInCrypto baru-baru ini juga mendukung hal tersebut, dan menyoroti bahwa reli emas sering membuka jalan bagi Bitcoin untuk naik.

Pada kasus Bitcoin, kompresi harga ini dipicu oleh apa yang analis derivatif sebut sebagai “gamma trap” senilai US$300 juta.

Menurut David, seorang analis struktur pasar, saat ini Bitcoin “secara mekanis terperangkap dalam rentang sempit” yang ditentukan oleh posisi opsi yang berat.

Batas bawahnya dijaga oleh dinding put US$85.000 yang menyimpan sekitar US$98,8 juta put gamma, sementara batas atasnya ditekan oleh dinding call US$90.000 yang menyimpan kurang lebih US$36,2 juta call gamma. Kondisi ini membentuk loop umpan balik negatif gamma.

Analis tersebut menjelaskan bahwa saat Bitcoin naik menuju batas atas, para dealer yang memegang call harus menjual spot Bitcoin untuk mengimbangi risikonya. Ketika harga turun ke batas bawah, para dealer yang sama wajib membeli untuk menyeimbangkan opsi put mereka.

“The result: Price is effectively locked in a cage,” dia terang, sambil menekankan bahwa pasar bukan digerakkan oleh sentimen atau berita, melainkan “karena keharusan matematika dari hedging dealer.”

Ketenangan ini bersifat sementara. Sekitar US$300 juta gamma, yang mencakup sekitar 58% dari total kompleks gamma, sudah kadaluarsa dalam satu event opsi hari ini. David menyebutnya sebagai “pin release,” seraya memperingatkan bahwa ketika kadaluarsa terjadi, insentif yang selama ini mengunci Bitcoin di antara US$85.000 dan US$90.000 akan menghilang hampir seketika.

Secara historis, pelepasan seperti ini sering memicu volatilitas yang tajam dan tiba-tiba saat pasar mencari keseimbangan baru.

Satu level kini menjadi sangat krusial. Apa yang disebut gamma flip berada di US$88.925. Ini sedikit di atas US$88.724, harga Bitcoin pada waktu publikasi.

Pergeseran harga secara konsisten di atas batas itu bisa membalik arus dealer dari menahan aksi harga menjadi memperkuatnya. Kondisi ini dapat memaksa dealer membeli di tengah reli, bukan lagi menjual saat harga naik.

Perbedaan arah antara emas dan Bitcoin juga berlangsung di tengah suasana ekonomi makro yang tegang. Ekonom Mohamed El-Erian baru-baru ini menyoroti bahwa emas telah naik lebih dari 40% tahun ini dan menjadi raihan tertinggi sejak 1979. Sementara itu, Bitcoin turun sekitar 20% secara year-to-date setelah sebelumnya sempat mencatatkan puncak di awal siklus.

Bitcoin and Gold this year. #markets #investing #investors #bitcoin #gold @FT pic.twitter.com/2jYe0czJCV

— Mohamed A. El-Erian (@elerianm) December 26, 2025

Pada saat bersamaan, banyak analis memperingatkan bahwa reli serempak di emas, perak, tembaga, dan pasar energi secara historis menjadi tanda meningkatnya tekanan sistemik. Hal ini selaras dengan laporan terbaru yang menyatakan reli logam bisa menandakan stres di sistem.

Meski begitu, banyak pengamat kripto menilai stagnasi Bitcoin sebagai fenomena struktural, bukan sinyal bearish.

SP500 – All-Time High!

— Ran Neuner (@cryptomanran) December 26, 2025

Nasdaq- All-Time High!

Gold – All-Time High!

Silver – Ripping, All-Time High

Platinum- All-Time High!

Palladium All-Time High!

Other world markets – All-Time High!

I don’t see a world where Bitcoin doesn’t catch up!

Dengan gamma trap yang hampir kadaluarsa, dan emas sudah memberi sinyal tekanan di sistem, kompresi harga Bitcoin yang berkepanjangan mungkin sedang membentuk panggung untuk pergerakan besar selanjutnya.

Berikut rangkuman berita aset kripto dari AS yang perlu kamu ikuti hari ini:

| Perusahaan | ||

| Strategy (MSTR) | US$158,71 | US$159,72 (+0,64%) |

| Coinbase (COIN) | US$239,73 | US$240,40 (+0,28%) |

| Galaxy Digital Holdings (GLXY) | US$24,43 | US$24,68 (+1,02%) |

| MARA Holdings (MARA) | US$9,94 | US$9,99 (+0,50%) |

| Riot Platforms (RIOT) | US$13,92 | US$14,02 (+0,72%) |

| Core Scientific (CORZ) | US$15,57 | US$15,63 (+0,39%) |

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and watch closely: while gold surges to new highs, signaling capital rotation toward safety, Bitcoin remains trapped below $90,000. A $300 million options structure suppressed volatility, but after the major expiry, this calm could quickly give way to dramatic price action.

Gold has surged to fresh highs, breaking above a multi-year ceiling and reinforcing its reputation as the market’s early warning signal when capital rotates toward safety.

Bitcoin, however, has failed to respond in kind. Instead, the world’s largest cryptocurrency remains pinned below $90,000.

New insights suggest it may not be due to fading demand, but rather to a massive derivatives structure that mechanically suppresses price movement.

“Gold made the first move. Bitcoin is still loading,” said analyst Crypto Tice.

The analyst explained that gold’s breakout often marks the point where liquidity begins to reposition, while Bitcoin typically reacts later, once risk appetite returns.

“Gold tends to move first when liquidity seeks safety. Bitcoin follows when risk appetite turns back on,” CryptoTice said, adding that such compressed phases “don’t fade out slowly” but instead resolve with expansion that can reset an entire market cycle.

It aligns with a recent BeInCrypto analysis, which highlighted how gold’s rally often sets the tone for Bitcoin to climb.

In Bitcoin’s case, that compression is being driven by what derivatives analysts have dubbed a $300 million “gamma trap.”

According to David, a market structure analyst, Bitcoin is currently “mechanically trapped in a tight range” defined by heavy options positioning.

The downside is anchored by an $85,000 put wall holding nearly $98.8 million in put gamma, while the upside is capped by a $90,000 call wall containing about $36.2 million in call gamma. This positioning has created a negative gamma feedback loop.

The analyst notes that when Bitcoin rises toward the upper range, dealers who are long calls are compelled to sell spot Bitcoin to hedge their exposure. When the price falls toward the lower range, those same dealers must buy to hedge puts.

“The result: Price is effectively locked in a cage,” he said, emphasizing that the market is not being driven by sentiment or headlines, but by “the mathematical necessity of dealer hedging.”

This stability is temporary. Roughly $300 million worth of gamma, about 58% of the total gamma complex, expired in a single options event earlier today. David described this as a “pin release,” warning that once the expiry hits, the incentives that have kept Bitcoin locked between $85,000 and $90,000 vanish almost instantly.

Historically, such releases have often led to sharp and sudden volatility as the market seeks a new equilibrium.

One level has become especially important. The so-called gamma flip sits at $88,925. This is slightly above $88,724, Bitcoin’s price as of this writing.

A sustained move above that threshold could flip dealer flows from dampening price action to amplifying it. Such a move could force dealers to buy into strength rather than sell rallies.

The divergence between gold and Bitcoin is also happening against a tense macroeconomic backdrop. Economist Mohamed El-Erian recently highlighted that gold has risen by more than 40% this year, its strongest performance since 1979. Manwhile, Bitcoin is down roughly 20% year-to-date after peaking earlier in the cycle.

Bitcoin and Gold this year. #markets #investing #investors #bitcoin #gold @FT pic.twitter.com/2jYe0czJCV

— Mohamed A. El-Erian (@elerianm) December 26, 2025

At the same time, multiple analysts have warned that a synchronized rally across gold, silver, copper, and energy markets historically signals rising systemic stress. It aligns with a recent report suggesting the metals rally may signal stress.

Still, many crypto observers see Bitcoin’s stagnation as structural rather than bearish.

SP500 – All-Time High!

— Ran Neuner (@cryptomanran) December 26, 2025

Nasdaq- All-Time High!

Gold – All-Time High!

Silver – Ripping, All-Time High

Platinum- All-Time High!

Palladium All-Time High!

Other world markets – All-Time High!

I don’t see a world where Bitcoin doesn’t catch up!

With the gamma trap nearing expiration and gold already signaling stress in the system, Bitcoin’s prolonged compression may be setting the stage for its next major move.

Here’s a summary of more US crypto news to follow today:

| Company | ||

| Strategy (MSTR) | $158.71 | $159.72 (+0.64%) |

| Coinbase (COIN) | $239.73 | $240.40 (+0.28%) |

| Galaxy Digital Holdings (GLXY) | $24.43 | $24.68 (+1.02%) |

| MARA Holdings (MARA) | $9.94 | $9.99 (+0.50%) |

| Riot Platforms (RIOT) | $13.92 | $14.02 (+0.72%) |

| Core Scientific (CORZ) | $15.57 | $15.63 (+0.39%) |

The post Today’s $300 Million Gamma Expiry Could Triger Bitcoin’s Next Big Move | US Crypto News appeared first on BeInCrypto.

For a long while, especially when I first started with a home lab and self-hosting services, my answer to everything was to self-host it. This mindset I think can serve…

The post Things I Stopped Self-Hosting (And Why Cloud or Managed Won) appeared first on Virtualization Howto.